Of all working families across the country, Oregon working families are among the least likely to claim the federal Earned Income Tax Credit (EITC). About a quarter of eligible families in Oregon did not claim the credit in 2013. Underuse of EITC that year meant that working families in Oregon collectively left $130 million on the table.

Lawmakers should charge a state agency with promoting the EITC and dedicate resources toward outreach to working families. With a modest investment, Oregon could pull into Oregon millions of federal dollars that would help working families better make ends meet and stimulate local economies.

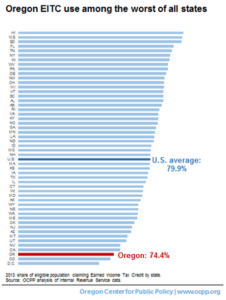

In 2013, the year with most recent data on EITC participation, about 299,000 Oregon families claimed the tax credit.[1] This accounted for 74.4 percent of all Oregon working families that were eligible that year.

Oregon’s participation rate ranked third worst among all states and the District of Columbia. Only Colorado and Washington D.C. performed worse in terms of EITC use in 2013.

This low ranking is not unusual, as Oregon for several years has ranked at or near the bottom nationally in terms of EITC participation.[2]

About 88,000 Oregon working families who were eligible for the EITC did not claim it in 2013. The Center conservatively estimates that these families left a total of $130 million in federal EITC dollars on the table that year.

Oregon’s poor performance is even more striking considering that Oregonians have an added incentive to claim the federal EITC: the state’s own EITC. Families that qualify for the federal EITC automatically qualify for the Oregon EITC. In 2013, the Oregon tax credit amounted to 8 percent of the federal tax credit.[3]

Working families in western states are less likely to claim the EITC, according to the Internal Revenue Service (IRS).[4] The IRS also observes that working families that live in rural areas, are self-employed, do not have a qualifying child, or are not proficient in English, are some of those less likely to claim the credit.[5]

The EITC helps working families make ends meet

The EITC is one of the most effective tools for supporting working families and reducing poverty. It does this by helping low- and moderate-income families keep more of the income that they earn in the form of a refundable tax credit. For working families, this means being better able to meet the rising costs of child care or catching up on a car payment.

In fact, the EITC is one of the most effective tools for alleviating poverty. When combined with the federal Child Tax Credit, the federal EITC helped lift 129,000 Oregonians, including 65,000 children, out of poverty each year between 2011 and 2013.[6]

The federal EITC adds dollars to the Oregon economy by giving working people more money to spend. Despite Oregon’s poor participation, the federal credit injected $586 million into the Oregon economy in 2013.[7]

Lawmakers must do something to boost EITC participation

Lawmakers should charge a department, such as the Department of Revenue, with the responsibility of providing information about the EITC to potentially eligible families. Research has shown that providing families with information about the credit in simple and accessible language, highlighting the size of the tax credit they may be eligible for, and sending them a reminder notice can help encourage more eligible families to claim their EITC.[8] By boosting EITC participation, lawmakers would not only be improving the lives of working Oregonians, they would also be drawing millions in federal dollars into Oregon’s economy that are otherwise left in Washington, D.C.

A note on methodology

To estimate the total amount of unclaimed EITC dollars, we considered participation rates by the number of dependents in a worker’s household, since participation varies by number of dependents. While it is unclear exactly which workers are less likely to claim their EITC, childless workers are perhaps the least likely because their credits are much smaller. Simply multiplying the estimated number of eligible workers not claiming the credit by the average EITC dollar amount would likely overestimate the total number of unclaimed dollars.

Instead, we use national 2009 EITC participation rates by number of dependents from a Census Bureau working paper as a proxy measure for Oregon’s participation rate for childless workers, workers with one dependent and workers with two or more dependents.[9] Given that Oregon’s overall participation rate is lower than the national average, the estimates derived using these participation rates are likely on the conservative end.

Taking the number of Oregon federal EITC claims by number of dependents, we divide by the respective participation rate to estimate the total number of workers eligible for the EITC by number of dependents.[10] Using those estimates, we subtract the number of actual claims to derive the estimated number of Oregon childless workers, workers with one dependent and workers with two or more dependents who did not claim the federal EITC.

We then multiply the number of eligible workers not claiming the EITC for each household type by the average EITC amounts for childless workers, workers with one dependent and workers with two or more dependents. We estimate the EITC unclaimed amount to be $14.4 million for childless workers, $33.2 million for workers with one dependent, and $82.4 million for workers with two or more dependents. Together, these figures provide a conservative estimate of $130 million in unclaimed federal EITC benefits in Oregon in 2013.

[1] For this fact sheet, unless otherwise noted, all figures are OCPP analysis of Oregon Department of Revenue (DOR) data and Internal Revenue Service (IRS) data. Published IRS data on participation rates include more than 95 percent of all Oregon tax returns claiming the EITC, but are incomplete. To estimate the number of eligible workers not claiming the EITC, we use DOR data of all Oregon tax returns claiming the EITC in tax year 2013 and the IRS’s published participation rate for that year.

[2] Last in EITC Participation: Oregon Leaves Millions on the Table, Oregon Center for Public Policy, November 5, 2015.

[3] During the 2016 legislative session, lawmakers increased the Oregon EITC to 11 percent of the federal credit for families with children under age three.

[4] Plueger, Dean, Earned Income Tax Credit Participation Rate for Tax Year 2005, Internal Revenue Service, July 2012.

[5] Others who may be less likely to claim their EITC include workers who receive certain disability pensions or have children with disabilities, are grandparents raising their grandchildren or, “are recently divorced, unemployed, or experience[d] other changes to their marital, financial, or parental status.” For more, see Internal Revenue Service, About EITC, January 2015.

[6] Oregon Fact Sheet: Tax Credits Promote Work and Fight Poverty, Center on Budget and Policy Priorities, September 2016.

[7] OCPP analysis of Internal Revenue Service data.

[8] Bhargava, Saurabh and Dayanand Manoli, “Psychological Frictions and the Incomplete Take-Up of Social Benefits: Evidence from an IRS Field Experiment,” American Economic Review, Vol. 105, No. 11, November 2015: 3489-3529.

[9] Jones, Maggie R., Changes in EITC Eligibility and Participation, 2005—2009, U.S. Census Bureau, Table 7, July 2014.

[10] Oregon federal EITC data by number of dependents emailed by Oregon Department of Revenue to Oregon Center for Public Policy. Data are for all filers.