This issue brief is also available as a PDF: Oregon Should Assist Laid-off Immigrant Workers Excluded from Federal Aid

Federal help for workers enacted in response to the coronavirus (COVID-19) crisis leaves out a key portion of Oregon’s workforce. Already excluded from most safety net supports, undocumented workers laid off from their jobs find themselves in an especially vulnerable situation.

Oregon’s undocumented immigrants are integral to urban and rural communities and vital to the state’s economy. They supply the labor for key industries, often for low pay. Some of these industries have been devastated by the coronavirus crisis. Despite the fact that they pay taxes, undocumented workers are ineligible for unemployment insurance, even under the expanded terms of the third federal relief act.

The economic crisis triggered by the coronavirus pandemic threatens to leave undocumented workers and their families — including many children who are U.S. citizens — with little means of support. Unless the Oregon legislature takes action to provide emergency wage replacement, we could see an even greater human tragedy unfold in our state.

Undocumented workers support key Oregon industries

Undocumented immigrants in Oregon play a vital role in the state’s economy.[1] They provide labor in key state industries, often for low pay.

Undocumented Oregonians are more likely to work than Oregonians in general. In 2014, 76 percent of undocumented Oregonians old enough to work were either working or looking for work, compared to 61 percent for Oregonians overall.[2] About 74,000 undocumented immigrants in Oregon of any age were employed, and an additional 6,000 were unemployed and looking for work.[3]

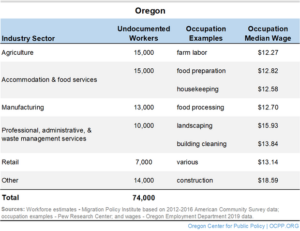

Undocumented immigrants work in a range of industries, including some key industries in the state. Undocumented workers make up more than a third of the workforce in Oregon’s agricultural sector.[4] Other industries relying on undocumented workers include accommodation and food services; manufacturing; professional, administrative, and waste management; and retail trade. Oregon’s construction industry also depends on undocumented workers.[5]

Undocumented immigrants typically carry out their work for low pay. In 2019, the median wage for a farm laborer in Oregon was $12.27 per hour, and for a hotel housekeeper it was $13.39 per hour.[6] These wages are far below the median wage for Oregon overall that year — $19.46 per hour.

As a result of the low wages they are paid, undocumented Oregonians have few resources to meet their basic needs. In 2014, two of every three undocumented Oregonians had income below 200 percent of the federal poverty line. That year, the share of undocumented Oregonians with income falling below the poverty line was 28.3 percent, much higher than Oregon’s overall poverty rate of 16.6 percent.[7]

Undocumented immigrants raise children

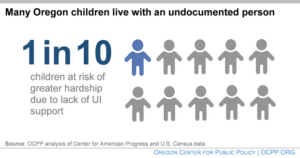

Oregon’s undocumented workers support families with children, most of whom are U.S. citizens. About 86,000 Oregon children live with a family member who is undocumented.[8] That is one of every ten Oregon children. The vast majority of those, nearly 83 percent, are U.S. citizens. Another 4 percent are non-citizen children authorized to live in the United States.

Federal pandemic relief package leaves out undocumented workers

The Coronavirus Aid, Relief, and Economic Security (CARES) Act — critical federal relief intended to shore up millions of American households hit by the crisis — will bypass undocumented workers. They are not eligible to receive the recovery rebate payments of $1,200 per adult. They are also ineligible for the additional $500 per child payment, even for children who are U.S. citizens.[9] An exception is people granted DACA status, who are eligible if they do not file taxes with a spouse who lacks a Social Security Number.[10]

Undocumented workers laid off during the crisis will not benefit from the CARES Act’s unemployment provisions — or existing unemployment benefits, for that matter. With few exceptions, undocumented workers do not qualify for Unemployment Insurance (UI) benefits,[11] even though their employer may contribute to the system on their behalf.[12] The CARES Act extended UI to self-employed and other groups ineligible for regular UI, but did not include undocumented workers.[13] As such, undocumented workers now being laid off will be without means to sustain themselves during the period of isolation, when social distancing is critical to personal and public health.

Undocumented workers pay taxes

Like other Oregonians across the state, undocumented Oregonians contribute federal, state and local taxes. Many pay income taxes and payroll taxes. They pay property taxes directly if they are homeowners and indirectly if they rent a residence. They also pay excise taxes on goods such as gasoline and alcohol.[14] In terms of state and local taxes, undocumented Oregonians pay about $81 million annually.[15]

Approximately 34,000 Oregonians filed taxes in 2015 using an Individual Taxpayer Identification Number (ITIN) — a number issued by the IRS to filers ineligible for a Social Security Number.[16] The vast majority of ITIN filers are undocumented residents. Though many have families to support, they are barred from claiming tax benefits otherwise available to lower-wage workers, such as the Earned Income Tax Credit, and, since enactment of the federal Tax Cuts and Jobs Act of 2017, the Child Tax Credit for undocumented children, as well.[17]

Oregon should assist undocumented workers ineligible for UI

For those it covers, Unemployment Insurance provides financial protection when a person involuntarily loses their job. UI enables families to meet their basic needs and helps protect against debilitating household disruption and economic hardship until another job can be found. In an economic downturn, UI sustains an industry’s workforce until the economy recovers and laid-off workers are needed again.

During this unprecedented health and economic crisis, Oregon should assist workers who are laid off yet ineligible for Unemployment Insurance due to their immigration status. Undocumented workers are workers — needed by their families to earn income, needed by their industries to supply labor. The same factors that make UI essential policy with regard to workers generally do apply in the case of undocumented workers. Given that the federal relief packages exclude undocumented workers, Oregon should provide them a wage replacement benefit on par with the Unemployment Insurance benefit for other laid-off Oregon workers. Doing so would be a lifeline for these families who have limited or no access to the supports available to other Oregonians in difficult circumstances.[18]

Read this report as a PDF: Oregon Should Assist Laid Off Workers Excluded from Federal Aid

Conclusion

Oregon’s undocumented workers play a key role in Oregon’s economy, even as they toil for low wages. Now, many of these workers find themselves without work and unable to turn to the Unemployment Insurance system to help them through the coronavirus crisis. Unless the Oregon legislature steps in to assist, Oregon could see an even greater human tragedy unfold.

[1] Unless otherwise noted, the information in this publication is from the Migration Policy Institute’s analysis of American Community Survey data for the period 2012 – 2016. For ease of communication, we use the mid-point year of 2014 as the reference year for this data. Because undocumented immigration to and from Oregon has been relatively stable in recent years, the figures for 2012 – 2016 are a reasonable estimate of the population today. See Jeffrey S. Passel, and D’Vera Cohn, Size of U.S. Unauthorized Immigrant Workforce Stable After the Great Recession, November 3, 2016, page 6.

[2] OCPP analysis of Migration Policy Institute data and data from the Oregon Employment Department, available here.

[3] These numbers include people granted Deferred Action for Childhood Arrivals (DACA) status, and Temporary Protected Status (TPS). The Migration Policy Institute methodology does not explicitly note that the estimate includes the DACA and TPS population; however, it does note that the method is the same one the Institute uses to estimate the DACA population, which is based on an estimate of the larger undocumented population. The methodology note and a link to the report of the DACA estimate is available here.

[4]Occupations with Highest Shares of Unauthorized Immigrant Workers by State, 2014, November 2, 2016.

[5] We have not found state data on the size of the undocumented immigrant population in the construction industry in Oregon; however, the Pew Research Center lists construction as a common industry nationally. Jeffrey S. Passel and D/Vera Cohn, “U.S. Unauthorized Immigrant Total Dips to the Lowest Level in a Decade,” Appendix C; Additional table.

[6] OCPP analysis of 2014 industry wage data from the Oregon Employment Department.

[7] Poverty in Six Charts, State of Working Oregon, Oregon Center for Public Policy, October 22, 2015.

[8] Analysis based on American Community Survey data for 2010-2014. Silvia Mathema, State-by-State Estimates of the Family Members of Unauthorized Immigrants, Center for American Progress, March 16, 2017, available at.

[9] An exception to the requirement that everyone in a tax filing group have a Social Security Number (SSN) to be eligible for the Recovery Payment is made for members of the armed services if one spouse has an SSN. CARES Act includes Essential Measures to Respond to Public Health, Economic Crises, But More Will Be Needed, Center on Budget and Policy Priorities, March 27, 2020.

[10] For some mixed status couples, filing separately could be problematic as it would create barriers to other vital supports. For instance, for a couple comprised of a DACA holder and person lacking a Social Security Number, filing separately would render the DACA holder ineligible for Affordable Care Act subsidies, which may be larger than the rebate. Understanding the Impact of Key Provisions of COVID-19 Relief Bills on Immigrant Communities, National Immigration Law Center, April 1, 2020.

[11] A few groups of undocumented immigrants — those with valid work permits, such as people with DACA or TPS status, are eligible for regular UI. Immigrant Workers’ Eligibility for Unemployment Insurance, National Employment Law Project, March 2020.

[12] Talia Ralph, “How Restaurants Hire Undocumented Workers,” Eater, February 28, 2017.

[13] “What American Workers Need to Know about Unemployment Insurance,”The Century Foundation, March 30, 2020. As of this writing, the Department of Labor has not issued guidance on whether DACA holders and other undocumented immigrants with valid work authorization are eligible for the CARES Act UI programs. Understanding the Impact of Key Provisions of COVID-19 Relief Bills on Immigrant Communities, National Immigration Law Center, page 9.

[12] Undocumented Workers Pay Millions in Oregon Taxes and Would Pay Millions more Under Immigration Reform, Oregon Center for Public Policy, April 14, 2017, available at. Also, “Economic Contributors, Undocumented Immigrants,” New American Economy.

[15] Ibid.

[16] Earned Income Tax Credit (EITC) Interactive Database,” Tax Policy Center, webpage, available at.

[17]Under the Tax Cuts and Jobs Act of 2017, tax filers using an ITIN number can no longer receive the refundable portion of the Child Tax Credit for dependents with an ITIN number. (ITIN numbers issued by the IRS for individuals ineligible for a Social Security Number). Those tax filers can still receive the refundable portion of the Child Tax Credit for dependent children with a Social Security Number. See Tax Reform Will Raise Costs for Many Immigrant Families, Bipartisan Policy Center.

[18]Tanya Broder, Avideh Moussavian, and Jonathan Blazer, Overview of Immigrant Eligibility for Federal Programs, National Immigration Law Center, revised December 2015.