Unless the Oregon legislature intervenes, some very rich business owners will receive a new tax cut from the state, just when schools and other essential services are starved for resources due to the coronavirus crisis. An obscure provision in the Coronavirus Aid, Relief, and Economic Security (CARES) Act created a new tax break whose only beneficiaries are a select group of rich business owners. The vast majority of the tax savings will go to business owners making more than $1 million a year. Because Oregon’s tax code connects to federal law, the state is on track to replicate the same tax cut – creating not one, but two tax breaks for these high-income business owners.[1] This tax break will cost about $90 million in the current budget period, when an unprecedented revenue collapse caused by the coronavirus crisis already threatens major budget cuts to schools and other essential services.[2]

While the best solution would be for Congress to repeal this flawed policy, the Oregon legislature nevertheless should act with haste to disconnect from this provision of the CARES Act.

This tax break largely benefits millionaires

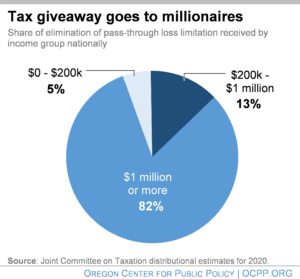

Only a select group of rich business owners stand to benefit from the new tax break created by Congress. So skewed is this tax break that the bulk of the tax benefits will flow to taxpayers with income above $1 million.

The tax break allows a business owner to use business losses to offset non-business income. Prior to 2018, an owner of a pass-through business (a partnership, S-corporation, or limited liability company) could deduct an unlimited amount of business losses from other sources of income, such as income from a large salary or capital gains from an unrelated investment. In late 2017, Congress passed the Tax Cuts and Jobs Act (TCJA), the largest tax overhaul in more than three decades. Although the TCJA mainly benefited corporations and the wealthy, the legislation limited the ability to use business losses to offset non-business income.[3] Under the TCJA, a married couple could not offset more than $500,000 in nonbusiness income and a single filer could offset no more than $250,000.[4] The CARES Act, however, did away with this cap, leaving no limit on how much a business owner can offset in loses. Not only was the cap ended for 2020, but it was also removed retroactively for 2018 and 2019.[5]

By design, the tax break in the CARES Act can only benefit the well-off. If you are a married couple, you need to earn more than $500,000 in non-business income to take advantage of the tax change. The Congressional Joint Committee on Taxation estimates that more than four out of five dollars of the tax savings will go to taxpayers with more than $1 million in income.[6] These millionaires will receive an average benefit of more than $1.6 million. Although 5 percent of the benefit will go to taxpayers currently making less than $200,000, these are taxpayers who made enough in a prior tax year (again, more than $500,000 for joint filers) to benefit retroactively from the tax break.

Owners of real estate businesses and hedge-fund investors stand to benefit in particular from this provision in the CARES Act.[7] Real estate developers and investors often are able to report tax losses that only exist on paper, not in real life. For example, real estate developers can use tax rules on depreciation to report a loss on the value of their properties, even though the actual value of their holdings may have increased.

Indeed, the ability to offset business “losses” against non-business income creates ample opportunities to game the system.[8] Consider a business owner who pays himself a $1 million salary from the business. Salary is considered non-business income. Because of that high salary, however, the business reports a loss for the year. The owner could then apply that business loss to offsetting his non-business (salary) income, resulting in a tax-free salary.

The tax break will make it even harder to fund schools and essential services

Tax breaks represent a loss of revenue to the state, and the loss to Oregon due to this particular tax break could not come at a worse time. Like all states, Oregon faces a large revenue shortfall as a result of the economic crash triggered by the pandemic. Since the last state revenue forecast, estimated revenue in the current and next two budget periods is down more than $10 billion.[9] Governor Kate Brown has called on state agencies to prepare lists of deep budget cuts because of plummeting state revenue.[10] These cuts would come just as more Oregonians struggling as a result of the crisis turn to the state for assistance, placing more demand on public health, human services, nutrition assistance, and other public structures.

This tax giveaway tucked into the CARES Act will cost Oregon nearly $90 million in foregone revenue in the current budget period, the Legislative Revenue Office estimates.[11] Clearly, Oregon has better uses for $90 million than giving it to millionaires in the form of a new tax break. That amount of revenue is enough to prevent all of the proposed budget cuts to programs that support children and adults living with developmental and intellectual disabilities, including funding for group homes and foster families.[12] That amount of revenue is also enough to prevent the firing of more than 1,100 teachers.[13] Alternatively, that revenue could beef up the Oregon Worker Relief Fund, a newly created fund intended to provide a wage replacement for laid-off immigrant workers excluded from the Unemployment Insurance system.[14] In the latter case, the resources could support more than 50,000 of those workers struggling to cover food and other basic needs for one month, rather than to a group consisting largely of millionaires.

Conclusion

Oregon cannot afford to give out a new tax break for millionaires. It is they who will largely benefit from the tax break snuck into the CARES Act that allows business owners to use unlimited business losses to offset non-business income. Such a policy was wrong prior to the coronavirus crisis; it is more so now, when the crisis threatens deep cuts to so many essential services. Congress should reverse course and end this tax break. But the Oregon legislature should not let Congress determine Oregon’s tax law – and should disconnect as quickly as possible from this piece of the federal tax code.

[1] More information about Oregon’s tax connection to federal law is available here.

[2] Coronavirus Aid, Relief, and Economic Security (CARES) Act (H.R. 748) Tax and Revenue Related Provisions, Oregon Legislative Revenue Office, May 2020; June 2020 Oregon Economic and Revenue Forecast, Oregon Office of Economic Analysis, May 20, 2020.

[3] TCJA by the Numbers, 2020, Institute on Taxation and Economic Policy, August 2019.

[4] Tax Policy Center, Briefing Book: How did the Tax Cuts and Jobs Act change business taxes?. The limitation was adjusted for inflation, reaching $518,000 for a married couple and $259,000 for a single filer in 2020.

[5] The retroactive nature of this provision illustrates that its impetus has little to do with the current pandemic.

[6] OCPP analysis of a Joint Committee on Taxation letter to Senator Sheldon Whitehouse and Representative Lloyd Doggett, dated April 9, 2020.

[7] Steven M. Rosenthal and Aravind Boddupalli, Heads I Win, Tails I Win Too: Winners From The Tax Relief For Losses In The CARES Act, Tax Policy Center, April 20, 2020; Jesse Drucker, Bonanza for Rich Real Estate Investors, Tucked Into Stimulus Package, New York Times, March 26, 2020.

[8] Clint Wallace, The Unlimited Pass-Through Deduction, April 30, 2020.

[9] June 2020 Oregon Economic and Revenue Forecast, Oregon Office of Economic Analysis, May 20, 2020.

[10] Dirk VanderHart, Gov. Kate Brown Orders Oregon Agencies To Plan Nearly $2 Billion In Spending Cuts, Oregon Public Broadcasting, April 28, 2020.

[11] Coronavirus Aid, Relief, and Economic Security (CARES) Act (H.R. 748) Tax and Revenue Related Provisions, Oregon Legislative Revenue Office, May 2020.

[12]2020 Budget Reduction Exercise, Oregon Department of Human Services, May 2020.

[13] OCPP calculation based on data provided by Oregon Department of Education in their Budget Scenario Planning process.

[14] See Oregon Worker Relief Fund website.