Measures 66 and 67 move Oregon closer to a tax system based on ability to pay

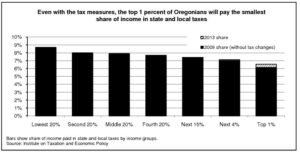

Today, low-income Oregonians pay a larger share of their income in state and local taxes than wealthy Oregonians. In fact, the highest-income Oregonians pay the lowest share of their income in state and local taxes. In addition to raising needed revenue, Measures 66 and 67 begin to address this imbalance.

Facing a revenue crisis brought on by the recession, the 2009 Legislative Assembly enacted two measures that will raise $733 million in new revenue in the 2009-11 biennium.[1] The modest tax increases on corporations and wealthy Oregonians helped avoid deeper cuts in education, health and human services and public safety than those already made to address a projected $4 billion shortfall in General Fund revenues.

Download a copy of this issue brief:

A Step Toward Balance: Measures 66 and 67 move Oregon closer to a tax system based on ability to pay (with charts and notes)

Related materials:

Download the accompanying charts that detail the effects of Measures 66 and 67 on Oregonians at different income levels

Read the news release Oregon Moves Closer to a Tax System Based on Ability to Pay: But even with Measures 66 and 67, the wealthy will pay proportionally less than the poor, October 12, 2009

One well-established principle for judging a tax system is whether revenues are raised based on the ability of taxpayers to pay the taxes.[2] Oregon’s tax system — all state and local taxes combined — currently fails that test, but the two revenue measures enacted by the 2009 legislature take Oregon one step closer to having a tax system based on ability to pay.

Measures 66 and 67 are a step toward a balanced tax system

After accounting for the deduction of state income taxes on federal tax returns, the lowest-income Oregonians currently pay 8.7 percent of their income in taxes, the highest share among all income groups. Middle-income Oregonians pay 7.9 percent. The wealthiest 1 percent — households with income in excess of $410,000 and averaging over $1 million — pay only 6.1 percent of their income toward state and local taxes.[3]

By 2013, both revenue measures will be fully implemented. Several changes aimed at ameliorating the fiscal crisis brought on by the recession — to avoid additional cuts in public services — are only temporary, and these will have expired.[4]

When Measures 66 and 67 are fully implemented, Oregon will have made some progress toward a tax system based on ability to pay. The lowest-income Oregonians will still pay the same 8.7 percent of their income in state and local taxes, but the share will increase for those at the highest levels of the income scale.[5] For the wealthiest 1 percent, for example, state and local taxes will increase from 6.1 to 6.6 percent of their income. For the next highest 4 percent of taxpayers, taxes will increase from 7.0 to 7.1 percent of income. These slight changes for those at the top 5 percent of the income scale constitute a small but important step toward making our tax system better based on ability to pay.

Measure 66 explained

Measure 66, the personal income tax measure, is implemented in phases.[6]

First, Measure 66 temporarily reduces taxes for unemployed Oregonians. It exempts the first $2,400 of unemployment insurance benefits from taxation in 2009. The average tax benefit will range from $142 for the lowest-income Oregonians to $179 for high-income Oregonians.[7]

Second, Measure 66 adds new tax rates that only high-income Oregonians will have to pay. For tax years 2009 through 2011, it requires couples to pay an additional 1.8 percent tax on income in excess of $250,000 and single taxpayers to pay the additional 1.8 percent tax on income in excess of $125,000. Couples will pay an additional 2 percent tax on income over $500,000, and single taxpayers will pay the additional 2 percent tax on income in excess of $250,000.

Starting in tax year 2012, new rates are implemented at a lower level. Couples will pay an additional 0.9 percent tax on income in excess of $250,000, and single taxpayers will pay the additional 0.9 percent tax on income in excess of $125,000.

Neither the initial or final new rates apply to a taxpayer’s entire income. They apply only to the portion of taxable income above the new tax bracket thresholds. For instance, a couple with taxable income of $260,000 in 2012 will pay 9.9 percent, as opposed to the current 9 percent, on only $10,000 in income. That means they will pay just $90 in additional taxes (0.9 percent of $10,000) under the new rate.

Finally, Measure 66 phases out the federal income tax subtraction for high-income taxpayers. The phase-out threshold begins at $250,000 in taxable income for couples and $125,000 for single taxpayers. The subtraction is fully eliminated for couples with $290,000 or more in taxable income and single taxpayers with $145,000 or more in taxable income. The amount of federal tax subject to the phase out is adjusted each year to reflect average monthly inflation for a 12-month period.

Measure 67 explained

The easiest way to understand Measure 67 is to examine its impact on different types of business entities.[8]

S-corporations

S-corporations are corporations with a limited number of shareholders and other characteristics that are allowed to elect to avoid the federal corporate income tax and pass through profits to shareholders for taxation under the federal personal income tax.[9] Under state law, they also pass through their Oregon profits to shareholders for taxation under the personal income tax and are subject to the minimum corporate excise tax. Under Measure 67, the only change that S-corporations will experience is that their minimum corporate excise tax will increase from $10 to $150.

Partnerships, LLPs and LLCs

Under Measure 67, partnerships, limited liability partnerships (LLPs) and limited liability companies (LLCs), each of which pass profits through to the owners similar to S-corporations, will pay a new $150 entity tax. Previously they paid nothing.

C-corporations

C-corporations are corporations subject to federal corporate income taxes.[10] Prior to the 2009 legislative changes, the minimum income tax for C-corporations in Oregon was $10, an amount set in 1931. In 2006, two-thirds of C-corporations operating in Oregon paid only the $10 minimum. Some paid only the minimum because they had no profits that year. Of the rest in 2006, 5,156 corporations had profits but were able to use tax credits, losses carried forward from prior years or both to reduce their tax liability to zero or less than the minimum tax. That year, 31 corporations had Oregon taxable income in excess of $1 million but were able to use these special tax provisions to reduce their tax liability to the $10 minimum.[11]

Measure 67 makes two changes affecting C-corporations. First, it modestly increases the tax rates on C-corporations that are making significant profits. They will pay an additional 1.3 percent tax on profits above $250,000. The increment drops to 1 percent in 2011. Starting in 2013, the additional tax will apply only to Oregon profits over $10 million, and the additional revenue from the tax on profits over $10 million will go into the state’s Rainy Day Fund.

Second, Measure 67 institutes a new minimum tax for C-corporations based on a sliding scale tied to Oregon sales. The sliding scale starts at $150 for corporations with less than $500,000 in Oregon sales revenues (30 cents for every $1,000 in sales). For corporations with $500,000 or more in Oregon sales, the new minimum tax will be no more than $1.50 on every $1,000 in sales and will be capped at $100,000 for corporations with sales of $100 million or more (i.e., less than $1.00 for every $1,000 in sales for companies with sales of more than $100 million).

Conclusion

The two revenue measures enacted by the 2009 legislature that voters are being asked to approve as Measures 66 and 67 help avoid deeper cuts to vital state services than those already taking place. Measures 66 and 67 also have the positive effect of moving Oregon one step closer to having a tax system based on ability to pay.

Endnotes

[1] See the revenue impact statements for HB 3405 and HB 2649, 2009 session, at www.leg.state.or.us/comm/sms/ris09/rhb3405a06-04-2009.pdf and www.leg.state.or.us/comm/sms/ris09/rhb2649a06-04-2009.pdf.

[2] See, e.g., ORS 316.003(2)(a).

[3] Institute on Taxation and Economic Policy analysis.

[4] The changes to the personal income tax will be fully implemented starting with tax year 2012. The changes to the corporate income tax will be fully implemented starting in tax year 2013.

[5] This analysis does not include other tax changes passed by the 2009 legislature, particularly transportation tax and fee increases that will ask more from low-income Oregonians as a share of their income than from any other group. See Oregon Center for Public Policy, Will Poor, Working Families Be Roadkill?, June 11, 2009, available at www.www.ocpp.org/cgi-bin/display.cgi?page=IS20090610EICGas.

[6] HB 2649, 2009 session.

[7] Oregon Center for Public Policy, Oregon Should Follow the Feds in Not Taxing Some Unemployment Benefits, May 21, 2009, available at www.www.ocpp.org/cgi-bin/display.cgi?page=IB20090521UITax.

[8] HB 3405, 2009 session.

[9] “S-corporation” is the standard term describing corporations qualifying for and electing the special tax benefits under federal Internal Revenue Code subchapter “S.”

[10] “C-corporations” refers to the federal Internal Revenue Code subchapter “C.”

[11] Oregon Center for Public Policy, “New Data Show Thousands of Profitable Corporations Pay No Oregon Income Taxes Except the $10 Minimum,” news release, February 23, 2009, available at www.www.ocpp.org/cgi-bin/display.cgi?page=nr20090223CorpTx.

More about: corporate income tax, corporate minimum tax, measure 66, measure 67, personal income tax