As rural counties in Oregon grapple with the loss of federal timber payments, a new study out today estimates that the tax break enjoyed by the wealthiest Oregonians as a result of federal tax cuts on capital gains and dividends exceeds the amount of the counties’ loss.

Download a copy of this news release:

Tax Break for Wealthiest Oregonians Exceeds Lost Timber Payments (PDF)

Related materials:

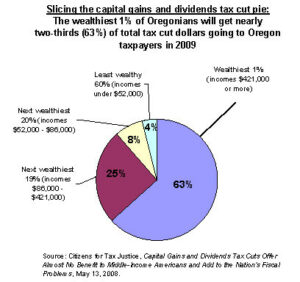

Chart and table illustrating the projected distribution among Oregon taxpayers of the capital gains and dividends tax cuts in 2009 (PDF)

Center for Tax Justice report Capital Gains and Dividends Tax Cuts Offer Almost No Benefit to Middle-Income Americans and Add to the Nation’s Fiscal Problems (PDF)

The preferential tax rates on capital gains and dividends enacted by Congress in 2003 will slash more than $350 million from the 2009 tax bill of the wealthiest 1 percent of Oregonians, according to the Washington, D.C.-based Citizens for Tax Justice (CTJ). The wealthiest fifth (the top 20 percent) of Oregonians are expected to reap about $500 million next year from the preferential tax treatment.

The amount going to the wealthiest 1 percent of Oregonians alone is more than the approximately $300 million shortfall that Oregon rural counties face this year as a result of the expiration of federal timber payments, said Janet Bauer, policy analyst with the Oregon Center for Public Policy.

The loss of federal timber payments threatens the ability of rural counties to fund key services such as road repairs, schools and public safety, according to Bauer.

“Congress must rethink its priorities,” she said. “Instead of giving special tax benefits to the very wealthy, who can get along without them, we should be investing in our people and infrastructure.”

The great majority of taxpayers in Oregon get little or no benefit from the tax cut on capital gains and dividends, according to CTJ. In 2009, the benefit will average just $21 for the 60 percent of taxpayers at the bottom of the income scale — many of whom will receive nothing at all.

By contrast, CTJ has calculated that the wealthiest 1 percent of Oregon taxpayers — with projected average incomes of more than $1.1 million — will on average save almost $21,000. As a group, Oregon’s wealthiest 1 percent of taxpayers will get 63 percent of all 2009 tax cut dollars going to state taxpayers, CTJ estimated.

“Oregonians distressed by the loss of federal timber payments and its devastating impact on Oregon’s rural infrastructure should question our members of Congress about the priority of lavishing tax cuts on the state’s wealthiest residents,” said Bauer.

The 2003 tax cuts championed by the Bush Administration lowered the top tax rate on capital gains — profits on investments such as stocks and bonds — from 20 percent to 15 percent. It also set the tax rate on dividends — profits paid out by corporations to shareholders — at 15 percent. Previously, dividends were taxed as ordinary income.

In 2005 alone, the tax cuts on capital gains and dividends sliced federal revenue by almost $92 billion nationwide, according to CTJ.

The tax cuts are set to expire in 2010, and the question of whether to extend them has become a political issue this campaign season.

The CTJ study aimed to dispel the myth that allowing the tax cuts to expire would harm the middle class, as suggested by ABC News’ Charlie Gibson in a question that he posed during last month’s Democratic presidential debate in Pennsylvania.

“The often repeated claim that raising taxes on capital gains would hurt the middle class is simply baseless,” said Bauer.

Most taxpayers do not benefit from the tax cuts on capital gains and dividends, said CTJ, because most of the stock they own is in 401(k) plans or Individual Retirement Accounts in which taxes are deferred until retirement, at which time they are taxed as ordinary income.

“It’s time to get rid of the preferential tax treatment for capital gains,” said Bauer. “It’s wrong that people who get their income from stock investments pay a lower tax rate than the vast majority of Americans, who work for their wages.”

The Oregon Center for Public Policy is a non-partisan research institute that does in-depth research and analysis on budget, tax, and economic issues. The Center’s goal is to improve decision making and generate more opportunities for all Oregonians.

Note to editors and reporters: Please find PDF versions of a chart and of a table illustrating the projected distribution among Oregon taxpayers of the capital gains and dividends tax cuts in 2009. The table and chart are also shown below.

| Income group | Income range per quintile ($) | Average 2009 income ($) | Average tax cut 2009 ($) | Total value of tax cut per quintile ($) | % of tax cut 2009 |

| Lowest 20% | Less than 17,000 | 10,500 | -0.08 | 27,378 | 0.005% |

| Second 20% | 17,000 – 32,000 | 24,100 | -9 | 3,065,018 | 0.5% |

| Middle 20% | 32,000 – 52,000 | 41,100 | -54 | 18,391,078 | 3.3% |

| Fourth 20% | 52,000 – 86,000 | 66,200 | -122 | 42,002,164 | 7.5% |

| Next 15% | 86,000 – 169,000 | 114,900 | -271 | 69,245,119 | 12.4% |

| Next 4% | 169,000 – 421,000 | 240,600 | -1,053 | 72,699,201 | 13.0% |

| Top 1% | 421,000 or more | 1,131,000 | -20,746 | 354,532,784 | 63.3% |

| ALL | 66,100 | -325 | 559,962,742 | 100.0% | |

| Source: Citizens for Tax Justice, Capital Gains and Dividends Tax Cuts Offer Almost No Benefit to Middle-Income Americans and Add to the Nation’s Fiscal Problems, May 13, 2008; email from Matt Gardner, Citizens for Tax Justice, May 12, 2008. | |||||

More about: bush tax cuts, capital gains