Measure 59, which would allow an unlimited deduction of federal income taxes on state tax returns, offers no tax break to more than three out of four Oregon taxpayers. And yet the measure’s hefty price tag — more than about 9 percent of General Fund revenues, each budget cycle — would force deep cuts in Oregon’s public structures.

Voters rejected a similar scheme in 2000. This year’s reincarnation of the unlimited federal tax deduction portends no gain, just pain for most Oregonians.

- Measure 59 would cost between $1.1 billion and $2.4 billion each biennium.

- Just the conservative $1.1 billion cost estimate is equivalent to the total funding that Oregon’s public universities will receive from the state in the current biennium or to cutting the salaries of all Oregon K-12 public school teachers by 70 percent.

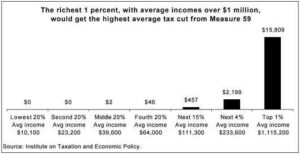

- Measure 59 would provide a tax break to only 22 percent of Oregon households, and most of it would go to those who are already well off. Households with annual incomes exceeding $83,200 would receive 97 percent of the tax break, leaving just 3 percent of the break to be divided by those with incomes under $83,200.

- The richest 1 percent of Oregonians — those with incomes of at least $405,100 and averaging over $1 million — would get nearly half the tax break set forth in Measure 59. This group of Oregon’s wealthiest households would receive an average tax cut of $15,809. Middle-income taxpayers (with $30,600 to $50,000 in annual income) would receive just two dollars, on average.

Download the full report (PDF).

More about: bush tax cuts, income inequality, personal income, personal income tax, tax expenditures