Undocumented Oregonians pay taxes. The taxes they pay help fund schools and other public services that strengthen the Oregon economy.

Undocumented Oregonians would contribute even more taxes should the U.S. Supreme Court uphold an Obama administration executive order offering temporary relief from deportation to certain immigrant children and parents. [1] The case affects an estimated 59,000 undocumented Oregonians. Their tax contributions to the state and to local governments would rise by more than $17 million should the court uphold President Obama’s executive order.

Oregon would collect even more tax revenue under comprehensive immigration reform that opens a path to citizenship for undocumented workers. Under such a scenario, these immigrant Oregonians and aspiring citizens would contribute so much more in state and local taxes that, as a share of their income, their tax payments would exceed those of Oregon’s wealthiest 1 percent.

Download a copy of this fact sheet:

Immigration Ruling Could Boost Oregon State and Local Budgets

Undocumented workers pay taxes — and would pay more if they gained legal status

Like other Oregonians working in the state, undocumented Oregonians contribute state and local taxes. Undocumented Oregonians pay income taxes, property taxes directly if they are homeowners and indirectly if they rent a residence, and excise taxes on goods such as gasoline and alcohol.

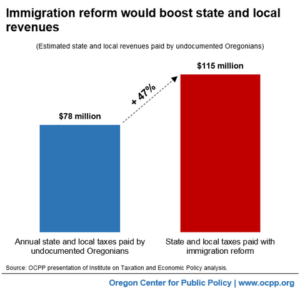

A recent report by the Institute on Taxation and Economic Policy (ITEP) estimates that 115,000 undocumented Oregonians pay more than $78 million in state and local taxes each year. [2] That is enough to hire more than 900 teachers. [3]

This group of immigrants would contribute even more if they were able to gain legal status. When previously undocumented workers receive legal status, they tend to earn and consume more. With greater earnings and consumption they contribute more in income, property and excise taxes. [4] Also, workers with legal status must be in full compliance with state and local tax systems. Thus, granting a pathway to citizenship increases the number of workers paying income taxes. These factors mean legal status would boost the tax contributions of undocumented residents.

Supreme Court ruling on immigration could boost Oregon state and local revenues

A case presently before the U.S. Supreme Court, United States v. Texas, has the potential of increasing the tax contributions of immigrant Oregonians.

In 2014, President Obama issued an executive order allowing certain undocumented parents and children to apply for temporary legal status. That executive order created the Deferred Action for Parents of Americans and Lawful Permanent Residents (DAPA) program and expanded the existing Deferred Action for Childhood Arrivals (DACA) program.

In response, Texas led a group of 25 states in suing the federal government on the grounds that the order would cost states money. [5] This action blocked the executive order, costing Oregon millions in foregone tax revenue. The U.S. Supreme Court is expected to hear arguments on an appeal of that case on April 18 of this year.

The DAPA and DACA programs, if fully implemented, would protect an estimated 59,000 undocumented Oregonians from deportation. [6]

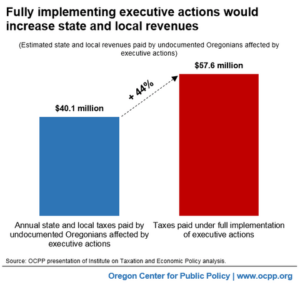

Currently, these Oregonians contribute an estimated $40 million in state and local taxes each year

ITEP estimates that these Oregonians would contribute over $17 million more with DAPA and DACA fully implemented, a 44 percent increase over their current contributions. [7]

Comprehensive immigration reform would further increase tax collections

Granting a pathway to citizenship for all undocumented Oregonians would further boost state and local tax collections.

As noted above, all undocumented Oregonians (not just those affected by the executive actions) pay more than $78 million in state and local taxes each year. Comprehensive immigration reform would increase Oregon state and local revenue by about $37 million a year. [8]

Thus, a path to citizenship would result in about a 47 percent increase in the tax contributions of Oregonians who are currently undocumented. [9]

Immigrants would pay a higher tax rate than the top 1 percent

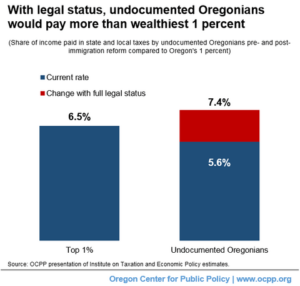

Immigration reform would increase the tax contributions of currently undocumented workers to such an extent that, as a share of their income, these workers would pay more in state and local income taxes than do Oregon’s wealthiest 1 percent.

As a group, undocumented Oregonians currently pay about 5.6 percent of their income in state and local taxes.

Immigration reform would elevate that share to about 7.4 percent. [10]

At that point they, like nearly all Oregonians, would pay a larger share of their income in state and local taxes than do Oregon’s wealthiest 1 percent, who as a group pay at a rate of about 6.5 percent.

Conclusion

Undocumented immigrants are important to Oregon’s economy and the taxes they pay is one of the ways they contribute to Oregon’s economy. Their tax contributions to schools and other key public services would increase should the U.S. Supreme Court uphold the Obama administration’s executive orders on immigration. They would increase even further under a comprehensive immigration reform effort creating a path to citizenship for undocumented Oregonians.

[1] In November of 2014, President Obama used his executive authority to expand Deferred Action for Childhood Adults (DACA), which protects certain undocumented youth from deportation; and to create Deferred Action for Parents of Americans and Lawful Permanent Residents (DAPA), which protects certain undocumented parents from deportation. For more on DACA and DAPA see National Immigration Law Center, Frequently Asked Questions: The Obama Administration’s DAPA and Expanded DACA Programs , March 2, 2015. For the text of the executive order see, Memorandum from Jeh Johnson, Secretary of the Department of Homeland Security, to Leon Rodriguez, Director of United States Citizenship and Immigration Services, et al., November 20, 2014.

[2] Christensen Gee, Lisa, Matthew Gardner and Meg Wiehe. Undocumented Immigrants’ State & Local Tax Contributions, Institute on Taxation and Economic Policy (ITEP), February 2016.

[3] The Oregon Department of Education estimates the average cost of an Oregon public school teacher’s salary and benefits was $85,660 in the 2014-15 school year. OCPP analysis of Oregon Department of Education data.

[4] Kallick, David Dyssegaard. Three Ways Immigration Reform Would Make the Economy More Productive, Fiscal Policy Institute, June 4, 2013, p. 18-20.

[5] State of Texas et al v. United States of America. No. 1:14-cv-00254 (D. Texas Feb. 16, 2015).

[6] Christensen Gee, Gardner and Wiehe. Undocumented Immigrants’ State & Local Tax Contributions, p. 22.

[7] Christensen Gee, Gardner and Wiehe. Undocumented Immigrants’ State & Local Tax Contributions, p.5.

[8] OCPP analysis of ITEP data.

[9] OCPP analysis of ITEP data.

[10] Christensen Gee, Gardner and Wiehe. Undocumented Immigrants’ State & Local Tax Contributions, p. 14.

More about: immigration, undocumented workers