Oregon’s public sector is not growing relative to Oregonians’ pocketbooks, notwithstanding what might be heard on Tax Day from the Tea Party movement. According to a report issued today by the Oregon Center for Public Policy, Oregon revenue and spending have remained stable as a share of Oregonians’ income over the past three decades.

“The public sector is no more expensive today than it was back in 1980,” said OCPP executive director Chuck Sheketoff. “It costs Oregonians roughly the same share of their total income as it did three decades ago.”

Download a copy of this news release:

Oregon Taxes and Spending Have Remained in Line With Oregonians’ Pocketbooks for Three Decades (PDF), April 14, 2010

Related materials:

Read the report Tax Day Reality Check: Oregon Revenue and Spending Have Remained Stable, April 14, 2010.

Read the news release Anti-Tax “Tea Parties” Draw Wrong Lesson From History: The Boston Tea Party was a protest against a corporate tax break, notes OCPP, April 14, 2009

That share is 15 percent of Oregonians’ pocketbooks, according to OCPP’s analysis of U.S. Census Bureau data from 1980 through 2007, the most recent available. With some fluctuations, in each of those years roughly 15 of every 100 dollars of Oregonians’ combined income went to state and local governments in the form of “own-source general revenue.”

Own-source general revenue encompasses all state and local taxes (including income and property taxes), fees and charges (such as college tuition and sewer fees) and certain “miscellaneous” revenue such as lottery receipts, according to the report. It does not include funds received from the federal government or “non-general revenue” such as the investment returns generated by the Public Employee Retirement System (PERS) trust fund.

The level of spending by state and local governments, in turn, hovered around 15 percent of Oregonians’ income from 1980 to 2007, the report found.

The fact that Oregon taxes and spending have remained stable for three decades is something that so-called Tea Party members are unlikely to acknowledge.

“If Tea Party political rhetoric matched reality, T-E-A would stand for ‘Taxes and Expenditures are Affordable,’ ” Sheketoff said. “The relative cost of the public sector has not changed.”

What has changed is who pays for public services, according to OCPP. Their report shows that over time corporations have shifted their responsibilities onto Oregon families.

Specifically, the report said that in 1980 corporate income taxpayers contributed 4.6 percent of total own-source general revenue in Oregon. By 2007, their share had declined to just 2.2 percent. Conversely, in 1980, personal income taxes — paid by Oregon households —constituted 22.6 percent of Oregon’s own-source general revenue. By 2007, that share had grown to 26.5 percent.

“The shift in taxes away from corporations and onto families is something worth protesting, in the spirit of the Boston Tea Party of 1773,” said Sheketoff. “When you take the time to check the facts you learn that Sam Adams and the other American patriots revolted against a tax break granted to a multinational corporation that supplied tea to the American colonies.”

Sheketoff also stressed that the Tea Party protestors ignore the public sector’s “vital role” in enhancing Oregonians’ qualify of life and fostering economic opportunity for families and businesses.

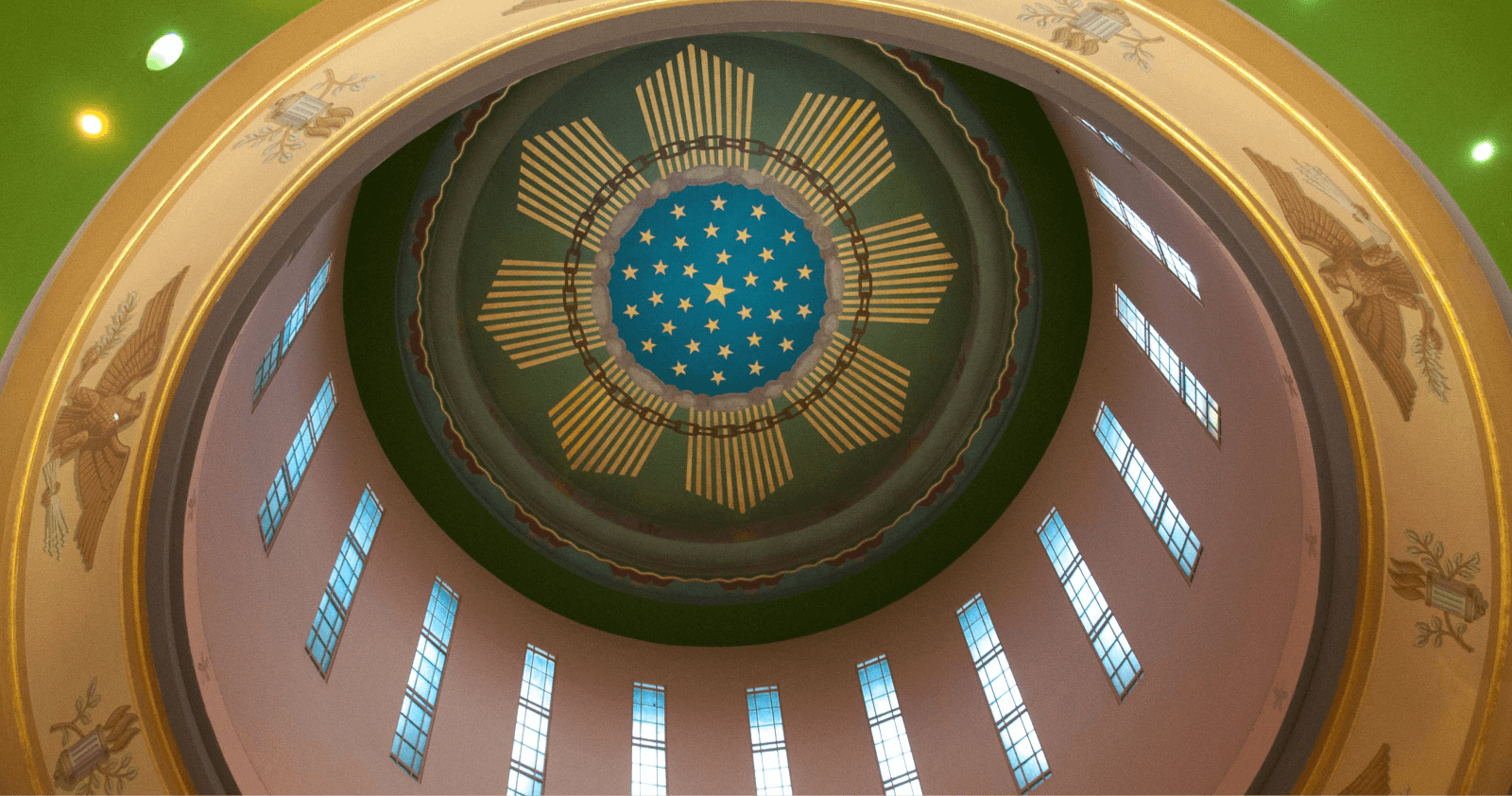

“April 15 — Tax Day — is a day to celebrate how Oregonians pool their resources to advance the common good, as reflected in our schools, courthouses and other public structures,” said Sheketoff. He noted that tax dollars created, and continue to maintain, the public spaces at the State Capitol that will host the Tea Party protest on Tax Day.

“It’s unfortunate,” Sheketoff concluded, “that the protestors ignore the reality that revenue and spending have remained stable and they refuse to celebrate the common good our taxes support.”

The Oregon Center for Public Policy is a non-partisan research institute that does in-depth research and analysis on budget, tax and economic issues. The Center’s goal is to improve decision making and generate more opportunities for all Oregonians.

Posted in Education, Health Care.

More about: gross state product, personal income, personal income tax, public safety, revenue