There are many ways to analyze the growing income inequality gap in Oregon. Here is one that could leave you feeling pangs of hunger: the distribution of capital gains income.

Capital gains income, of course, is income derived from the profitable sale of assets such as stocks, bonds and real estate.

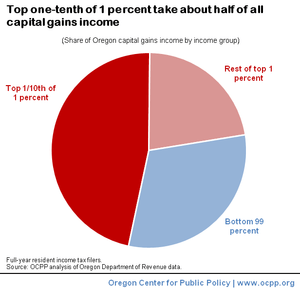

It’ll probably come as no surprise to most to hear that Oregon’s capital gains income is concentrated among the wealthy. But just how concentrated?

Picture the disparity of capital gains income by imagining a pizza with 10 slices and 1,000 people in the room. This is how the pizza gets divided:

- Just one person (“Mr. Top One-Tenth of 1 Percent”) takes five slices and leaves.

- Nine other people (“The Rest of the Top 1 Percent Family”) share two slices as they exit the room.

- The other 990 people (“The 99 Percent”) are left to divvy up the remaining three slices.

If you prefer the data served in a wonkier dish rather in a pizza pan, here’s the breakdown: In 2009, the top one-tenth of 1 percent collected nearly half (47 percent) of all capital gains income. The rest of the top 1 percent took in another 22 percent. Together, the entire top 1 percent collected a little more than two-thirds (69 percent) of all capital gains income in Oregon. The rest of Oregon taxpayers, the remaining 99 percent, were left to share the remaining third (31 percent).

Thus, a cut in the income tax on capital gains is one of the most lopsided tax cuts you can have, by-and-large a tax cut for the 1 percent — and especially for Mr. Top One-Tenth of 1 Percent.

And yet, the Oregon Business Council and others have served up a reheated version of their perpetual call for a cut in the income tax on capital gains. It appears in the latest iteration of the Oregon Business Plan.

Of course, the Oregon Business Council and others argue — incorrectly — that it’s necessary to attract investment. As OCPP explained in detail earlier this year in The Four Flaws of a Capital Gains Income Tax Cut,

Cutting the income tax on capital gains is also ineffective as a means to attract investment, contrary to what proponents claim. Research shows that there is no correlation between growth in the economy — real GDP growth — and the tax rate on income from capital gains. Demand for products and services, not the amount of after tax income, is what drives investment.

Let’s hope lawmakers watch out for the interests of the 99 percent and refuse to take a bite out of that portion of the Oregon Business Plan.

This blog post was originally posted on www.blueoregon.com on December 22, 2011. The original post can be found at http://www.blueoregon.com/2011/12/if-oregon-capital-gains-income-were-pizza/,

More about: capital gains, income inequality, state of working oregon