Read this report as a PDF: Low EITC Participation Costs Oregon Dearly

Oregon families are among the least likely to benefit from the Earned Income Tax Credit (EITC) — a tax credit designed for families surviving on low wages. In 2016, only two states had worse EITC participation than Oregon. That year, more than one in four eligible Oregon households did not claim the credit, collectively missing out on $137 million in federal and state dollars.

Oregon needs to do more to reduce barriers to accessing the EITC — a credit shown to reduce poverty, improve health, and lead to better child outcomes.[1]

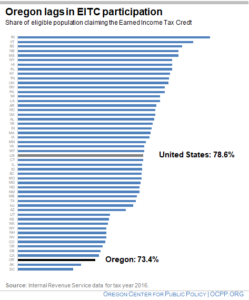

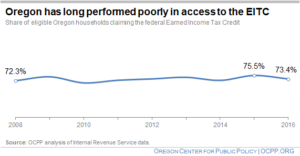

Oregon consistently has one of the nation’s lowest EITC participation rates

In 2016, the year with the most recent data on EITC participation, about 286,000 Oregon families claimed the tax credit.[2] This accounted for 73.4 percent of all Oregon working families that were eligible that year.

Oregon’s participation rate in 2016 was the third worst in the country, with 48 states faring better. Only the District of Columbia and Alaska had EITC rates worse than Oregon that year.

About 104,000 Oregon working families who were eligible for the EITC in 2016 did not access it. Together, these families forewent about $137 million that year — $127 million federal dollars and $10 million Oregon dollars.[3]

Oregon’s poor performance in 2016 is consistent with its long-term pattern. Oregon’s EITC participation rate has narrowly fluctuated over the prior eight years, never rising above 75.5 percent. Oregon’s rate of 73.4 percent in 2016 was virtually the same level as eight years earlier. During this period, Oregon never ranked better than 44th in the nation in terms of EITC participation. In some years — 2010, 2011, and 2012 — it tied for or ranked last in the nation.

Low EITC participation exacerbates challenges for working families

The EITC is one of the most effective tools for helping working families meet their basic needs and improve their lives. In 2016, the average federal and state credits combined for households that claimed them was $2,268. Of those that included children, the average was even higher — $3,160.[4] The amounts provided by this refundable tax credit typically help families catch up on bills, purchase or repair a car, or invest in activities that enrich their children’s lives.[5]

The broad benefits of the EITC are well documented. When combined with the federal Child Tax Credit, the federal EITC helped lift 129,000 Oregonians, including 65,000 children, out of poverty in the years after the Great Recession, from 2011 to 2013.[6] For children, the EITC has a lasting impact. A substantial body of research shows that tax credits such as the EITC improve child health, boost school performance, promote college enrollment, and increase earnings when children become adults.[7]

Barriers to the EITC make life unnecessarily difficult for children and families surviving on low wages.

Oregon’s economy suffers when few people use the EITC

Oregon’s low EITC participation not only undermines the well-being of families, it also represents a loss to the state. The EITC adds dollars to the Oregon economy by giving working people more money to spend. In 2016, the federal EITC brought over $603 million in federal dollars to Oregon, dollars that flowed to every corner of the state. Nevertheless, Oregon left $127 million (a conservative estimate) in federal dollars on the table, due to the fact that families eligible for the EITC did not claim the credit.

The economic loss to Oregon is even greater than that. Eligible families tend to spend their EITC refunds quickly at local businesses, as they make purchases to meet their basic needs. This spending generates more economic activity. Researchers estimate that each federal EITC dollar results in $1.40 to $1.58 in activity in the economy, as local businesses use EITC dollars to purchase goods and services and pay employees, and employees spend their earnings.[8]

Oregon should reduce barriers to EITC Participation

Households eligible for the EITC face numerous obstacles to claiming the credit. These include lack of awareness of the credit, complex tax forms, and misunderstandings about eligibility and benefits.[9] While tax preparation assistance can improve use of the credit, the perceived and actual cost of getting assistance can be a hindrance.[10] Workers less likely to claim the credit are those who live in rural areas; are self-employed; have disabilities; are not proficient in English; or have no dependents, resulting in a relatively small refund.[11]

Oregon has taken modest steps recently to increase use of the EITC, but more needs to be done. In 2017, the legislature began requiring employers to provide workers written notice at tax time of the federal and state tax credits.[12] Because current participation data only runs through 2016, it is too early to tell whether the 2017 legislation has increased use of the EITC. While this approach may help Oregonians overcome the problem of lack of awareness of the credit, it does not address other barriers, such as those related to the cost and complexities of filing taxes.

To boost participation, Oregon lawmakers should institute additional strategies to help low-wage families overcome barriers to filing a tax return and claiming the credit. Some of the strategies Oregon could pursue include:

- Increase awareness of the EITC. Oregon could launch or redouble its outreach efforts through key connectors such as employers, schools, utility companies, public benefit organizations, money management services, and faith organizations. Strategies could include community-based outreach, social and earned media campaigns. Efforts could target groups with lower usage such as foster parents, workers with disabilities, homeless workers, rural workers, tribal members, veterans, immigrants, and domestic violence survivors.

- Invest in free tax preparation services. The state could meaningfully invest in free tax preparation services targeted to eligible households. Privately-funded community-based tax preparation programs have served some Oregon communities in recent years, but some have also foundered for lack of on-going support.[13] Public investment is vital to creating a sustainable network of free tax preparation services available to those who need them throughout the state.

- Simplify the tax filing process. Oregon could explore ways to automate the steps involved for low-wage households in filing a tax return and claiming the EITC.

Conclusion

Oregon’s pattern of low EITC participation continued in 2016, when it ranked third lowest in the nation. The low participation rate deprives households surviving on low wages the economic and social advantages an EITC refund can bring, while denying the state of the economic benefits of the infusion of federal dollars. Oregon should take concrete steps to remove barriers that families face when it comes to claiming this vital tax credit.

A note on methodology

In estimating the foregone dollars of Oregon’s low EITC participation, simply multiplying the estimated number of eligible but non-claiming households by the average EITC credit would likely overestimate the total unclaimed dollars, for the following reason. We know from the IRS that workers without dependents are less likely to claim the EITC,[14] and the EITC offers much smaller benefits to these filers than households claiming dependents. Therefore, our approach to estimating foregone EITC dollars considers the unique participation rates by households according to number of children claimed.

We use national 2009 EITC participation rates by number of dependents from a Census Bureau working paper as a proxy measure for Oregon’s participation rate for childless workers, workers with one dependent and workers with two or more dependents.[15] With this proxy and the number of actual EITC claimants by family type by number of children in 2016 from unpublished IRS data, we derive an estimate of the total eligible and the number of non-claimants by family type. To calculate an estimate of the amount of foregone dollars by family type, the latter is multiplied by the average EITC benefit for each family type in Oregon for 2016 — figures also from IRS unpublished data. The total foregone EITC dollars is the sum of the estimated foregone dollars for each of the three family types. Given that Oregon’s overall participation rate is lower than the national average in 2009, the estimates derived using this method are likely conservative.

The amount of the Oregon credit is additionally derived by multiplying the total amount of foregone federal dollars by the Oregon statutory rate effective in the 2016 tax year of 8 percent.

[1] Chuck Marr, Chye-Ching Huang, Arloc Sherman, and Brandon Debot, The EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds, Center on Budget and Policy Priorities, October 1, 2015, available at.

[2] For this fact sheet, unless otherwise noted, all figures are OCPP analysis of Internal Revenue Service (IRS) data. The most recent data on state EITC participation was released by the IRS in October 2019 for 2016 tax filings.

[3] OCPP analysis of IRS data. See “A note on methodology” section for details.

[4] OCPP analysis of Oregon Department of Revenue data.

[5] Ruby Mendenhall et al., “The Role of Earned Income Tax Credit in the Budgets of Low-Income Families,” Social Service Review, February 2012.

[6] Oregon Fact Sheet: Tax Credits Promote Work and Fight Poverty, Center on Budget and Policy Priorities, September 2016.

[7] Ibid. Chuck Marr, Chye-Ching Huang, Arloc Sherman, and Brandon Debot, The EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds, Center on Budget and Policy Priorities, October 1, 2015.

[8] OCPP analysis of findings: Antonio Avalos, Sean Alley, “The Economic Impact of the Earned Income Tax Credit (EITC) in California,” The California Journal of Politics & Policy, 2010, Vol. 2, Issue 1. Also, Targeted Messages Why me? EITC and Other Refundable Credits, IRS.

[9] Saurabh Bhargava, Dayanand Manoli, “Psychological Frictions in and the Incomplete Take-up of Social Benefits: Evidence from an IRS Field Experiment,” American Economic Review, 2015, 105(11): 3489-3529.

[10] Accessing on-line free tax preparation software can be difficult for people with low-incomes who are eligible. See “H&R Block, Turbo Tax Accused of Obstructing Access to Free Tax Filing,” NPR, May 7, 2019. In-person free tax preparation assistance is available in some communities in Oregon, but fall short of addressing the need. Riley Eldredge, Director of Cash Oregon/Metropolitan Family Services, estimates the free tax preparation infrastructure in 2020 to be about one-seventh of the needed capacity. His statement made during Governor Kate Brown’s EITC Work Group, “Supporting Taxpayers” subcommittee, December 9, 2019.

[11] IRS, “About EITC” website. Also, Marsha Blumenthal, “Participation and Compliance with the Earned Income Tax Credit,” National Tax Journal, Vol. 58, N. 2 (June, 2005). Pp. 198-213.

[12] SB 398 (2017).

[13] Statements by Janet Byrd, Executive Director, Neighborhood Partnerships, made during Governor Kate Brown’s EITC Work Group, “Supporting Taxpayers” subcommittee, December 9, 2019.

[14] Ibid. IRS, “About EITC” website.

[15] Jones, Maggie R., Changes in EITC Eligibility and Participation, 2005—2009, U.S. Census Bureau, Table 7, July 2014.