As vaccines for COVID-19 make their way into the arms of Americans, a sense of normality feels within reach. But going back to normal is not what working Oregonians need. We need a reimagined sense of “normal” – one in which workers get paid living wages and the rich pay their fair share.

When you add up all the taxes Oregonians pay at the state and local level, low-income workers pay more in taxes than the rich as a share of income. This upside-down tax system not only benefits the rich more, it also makes it harder for many Oregonians to make ends meet. We need to change this system to ensure economic prosperity is broadly shared.

While most people think about income taxes when they think about the tax code, income taxes are just a portion of what makes up our tax system. Oregon does not have a general sales tax, but it does have excise taxes — sales taxes on particular goods such as tobacco, gasoline, and cannabis. Oregon’s excise taxes, along with property taxes collected by local governments, hit low-income Oregonians hardest because they are not based on people’s ability to pay.

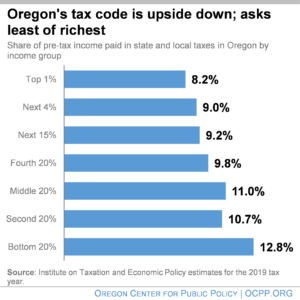

A recent analysis by the Institute on Taxation and Economic Policy shows us this upside-down tax structure. ITEP estimates that the bottom 20 percent of Oregonians (with incomes of less than $16,100 in 2018) pay 12.8 percent of their income on state and local taxes. Those in the middle (with incomes under $57,100) pay 11 percent. Meanwhile, the richest 1 percent of Oregonians, with average incomes of more than $1 million, pay 8.2 percent. No other group pays less as a share of income than the richest Oregonians.

A regressive state and local tax structure has been the normal state of affairs for many years — a period during which income inequality has soared to record highs. Tweaks here and there have made the tax structure more or less regressive, more or less based on people’s ability to pay. But never has the legislature sought to flip over the upside-down tax structure, to make it truly progressive.

It’s important to recognize that progressivity is not the only principle by which to judge a tax code; the tax system must raise enough resources to pay for the services that Oregonians need. In 2019, the Oregon legislature enacted the Corporate Activity Tax (CAT), a relatively modest “gross receipts” tax that kicks in when a business sells over $1 million worth of goods and services in Oregon. This tax created a historic investment in Oregon’s K-12 schools and early education system that’s been badly needed for years. Yet, strictly speaking, the CAT is not expected to help make Oregon’s tax structure more progressive, as some of the costs may be passed on to consumers, though how much is unknown at this time.

Tax codes must also be evaluated based on whether they worsen or rectify racial inequities embedded in our society and economy. Analyzing the racial impact of Oregon’s state and local tax code is an ongoing project, but the data points to the system as a whole being unhelpful, and certain provisions making things worse for Black, Indigenous, and other Oregonians of color.

The good news is that there are obvious steps for the legislature to correct the unfairness in our tax system. To list just a few:

- Cut taxes on low-income workers by boosting the state’s Earned Income Tax Credit and expanding it to workers currently excluded from this tax credit for low-income families.

- Reform or eliminate tax breaks that mainly benefit the richest Oregonians. The $1-billion mortgage interest deduction, Oregon’s biggest housing subsidy, should be at the top of the list.

- Clamp down on tax avoidance by big corporations. Corporate tax increases largely fall on rich investors and shareholders, making corporate income taxes a very progressive form of taxation. Oregon can compel corporations to pay taxes on the profits earned here but artificially shifted abroad through a strategy known as Complete Reporting. Oregon should also require large corporations to make their tax information public.

- And, of course, raise tax rates on the rich and corporations.

These and other proposals appear in our 2021 Legislative Agenda.

The tax system plays a huge role in determining the degree of economic security and opportunity that Oregonians enjoy. For too long, our upside-down tax structure has weighed more heavily on those with fewer financial resources, while asking proportionally less from those with the most resources. That needs to change. For the good of all Oregonians, we need to flip our state and local tax system.

A better reality for Oregonians requires flipping the tax system

A better reality for Oregonians requires flipping the tax system

A better reality for Oregonians requires flipping the tax system

As vaccines for COVID-19 make their way into the arms of Americans, a sense of normality feels within reach. But going back to normal is not what working Oregonians need. We need a reimagined sense of “normal” – one in which workers get paid living wages and the rich pay their fair share.

When you add up all the taxes Oregonians pay at the state and local level, low-income workers pay more in taxes than the rich as a share of income. This upside-down tax system not only benefits the rich more, it also makes it harder for many Oregonians to make ends meet. We need to change this system to ensure economic prosperity is broadly shared.

While most people think about income taxes when they think about the tax code, income taxes are just a portion of what makes up our tax system. Oregon does not have a general sales tax, but it does have excise taxes — sales taxes on particular goods such as tobacco, gasoline, and cannabis. Oregon’s excise taxes, along with property taxes collected by local governments, hit low-income Oregonians hardest because they are not based on people’s ability to pay.

A recent analysis by the Institute on Taxation and Economic Policy shows us this upside-down tax structure. ITEP estimates that the bottom 20 percent of Oregonians (with incomes of less than $16,100 in 2018) pay 12.8 percent of their income on state and local taxes. Those in the middle (with incomes under $57,100) pay 11 percent. Meanwhile, the richest 1 percent of Oregonians, with average incomes of more than $1 million, pay 8.2 percent. No other group pays less as a share of income than the richest Oregonians.

A regressive state and local tax structure has been the normal state of affairs for many years — a period during which income inequality has soared to record highs. Tweaks here and there have made the tax structure more or less regressive, more or less based on people’s ability to pay. But never has the legislature sought to flip over the upside-down tax structure, to make it truly progressive.

It’s important to recognize that progressivity is not the only principle by which to judge a tax code; the tax system must raise enough resources to pay for the services that Oregonians need. In 2019, the Oregon legislature enacted the Corporate Activity Tax (CAT), a relatively modest “gross receipts” tax that kicks in when a business sells over $1 million worth of goods and services in Oregon. This tax created a historic investment in Oregon’s K-12 schools and early education system that’s been badly needed for years. Yet, strictly speaking, the CAT is not expected to help make Oregon’s tax structure more progressive, as some of the costs may be passed on to consumers, though how much is unknown at this time.

Tax codes must also be evaluated based on whether they worsen or rectify racial inequities embedded in our society and economy. Analyzing the racial impact of Oregon’s state and local tax code is an ongoing project, but the data points to the system as a whole being unhelpful, and certain provisions making things worse for Black, Indigenous, and other Oregonians of color.

The good news is that there are obvious steps for the legislature to correct the unfairness in our tax system. To list just a few:

These and other proposals appear in our 2021 Legislative Agenda.

The tax system plays a huge role in determining the degree of economic security and opportunity that Oregonians enjoy. For too long, our upside-down tax structure has weighed more heavily on those with fewer financial resources, while asking proportionally less from those with the most resources. That needs to change. For the good of all Oregonians, we need to flip our state and local tax system.

Alejandro Queral

Action Plan for the People

How to Build Economic Justice in Oregon

relevant topics

2026 will require creativity and resolve from all Oregonians

Kicker has cost Oregon close to $11 billion over the last decade

OCPP’s Top 5 Stories of 2025, the Year of the Monstrous Budget Bill

Action Plan for the People

How to Build Economic Justice in Oregon

Latest Posts

Guaranteed income keeps Oregonians stable and housed

Download a PDF of this fact sheet. Cash is an effective tool to help families afford the ever-rising cost of

2026 will require creativity and resolve from all Oregonians

We have to regain our balance and go on the offense.

Kicker has cost Oregon close to $11 billion over the last decade

Oregon spent nearly $11 billion over the past decade on kicker tax rebates, with more than 62 percent of that

Your donation helps build Economic Justice in Oregon

Your donation helps build Economic Justice in Oregon