The reconciliation bill passed by the U.S. House ahead of Memorial Day is definitely big, taking up more than 1,000 pages. What’s in those pages, however, is truly ugly — a monstrosity. At its core, the package slashes health coverage and food assistance for struggling families to pay for tax cuts largely for the rich.

But for Oregonians, it’s even uglier. Because much of Oregon’s tax code is set up to mirror federal tax law, the House reconciliation bill would shrink state revenue collections at a time when the federal government would shift more of the costs of health care and nutrition assistance to the state.

Huge ugly bill leaves Oregonians hungry and sick . . .

Republicans in the House and Senate are working with President Trump to combine historically large cuts to health coverage and food assistance with a set of tax cuts that disproportionately help the wealthy. If enacted, this legislation will make Oregonians sicker and hungrier, while burdening the state with more of the cost of essential safety net programs.

. . . to pay for egregious tax cuts for the rich

The reason for these cuts is to offset the cost of renewing and expanding the upside-down tax cuts enacted in 2017 during the first Trump administration. Some of those tax cuts are set to expire at the end of the year. Instead of just renewing those tax cuts already favoring the most well-off, Congress is doubling down with a pile of new tax cuts.

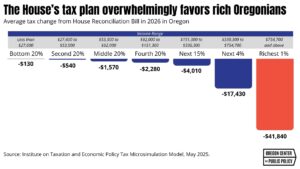

Combining the old and new tax cuts shows exactly how upside-down these proposals are. The lowest-earning 20 percent of Oregonians, earning an average of $15,600 per year, would receive an average of $130 in tax cuts. The richest 1 percent of Oregonians, averaging $1.6 million in annual income, would get a tax cut averaging nearly $42,000.

Even benign-sounding tax provisions are damaging: the example of exempting overtime from taxation

While it is crucial to keep in mind that the tax package as a whole is flowing disproportionately to the rich, we can also look at some of the more specific tax provisions on their own.

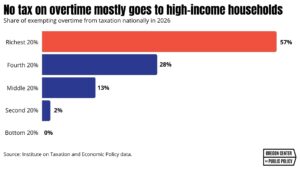

One proposal in the House Budget Reconciliation is to exempt overtime income from taxation, a proposal that turns out to also be upside-down. While people may picture a middle-class worker when they hear overtime, the reality is more complicated. It’s estimated that the middle 20 percent of workers would average a $210 tax cut from the provision, while the richest 20 percent would average nearly five times as much, $940. Estimates for the lowest-earning 20 percent can be rounded to zero.

For this regressive tax cut, the federal government expects to lose more than $35 billion per year. To be clear, its poor targeting and high cost are only some of the many reasons to continue taxing overtime.

Oregon will pay the price for many bad tax provisions, unless the legislature acts

Oregon’s tax code automatically connects with parts of the federal tax code, meaning that tax changes at the federal tax level often become Oregon law without the Oregon legislature changing any state statutes. Oregon automatically copies wasteful federal tax cuts, unless the Oregon legislature passes a law to “disconnect” from those provisions.

Consider the prior example of exempting overtime income from income taxes. Current analyses forecast that Oregon would automatically connect to this policy and duplicate it in our tax code. One estimate of the revenue hit for Oregon is $322 million per year.

That’s a big loss of revenue. It’s roughly the same amount that policymakers say is needed every biennium to address wildfire prevention and protection, but which currently remains unfunded by the legislature.

And that is just one example among dozens of potential ways Oregon stands to lose revenue due to the big, ugly federal bill. Since the legislation is still being worked on and is expected to be changed significantly in the U.S. Senate, what follows is a high-level taster of potential risks for Oregon’s tax system:

- Exempting tips from income taxes and a new deduction for auto loan interest could each cost the state tens of millions of dollars per year.

- The proposed weakening of the State and Local Tax (SALT) deduction cap could also result in tens of millions of dollars in less revenue each year.

- Additional changes to tax breaks for pass-through business entities could also create additional revenue losses in Oregon. This includes changes to business asset depreciation, research and development expensing, and the weakening of provisions intended to tax corporations that hide profits overseas.

- A new effort to provide tax breaks for contributions to private school scholarships could result in some Oregonians avoiding capital gains taxes, costing the state more than $5 million over the next decade. And because taxes on capital gains income flow to the Oregon General Fund, the principal source of funding for K-12 schools in Oregon, this provision would shift resources away from public schools that serve everyone to private schools that serve the few — especially the wealthiest families.

- The renewal, with modest revisions, of the Opportunity Zones tax break for capital gains would mean a continued loss of state revenue. Though the tax break has been adjusted to be more targeted at high-poverty rural communities, Opportunity Zones will continue to offer generous, capital gains tax breaks, which overwhelmingly flow to the rich.

To be fair, there are a small number of items that could provide additional revenue in Oregon:

- A new limit on itemized deductions could raise some revenue, although Oregon’s connection to this provision is less certain, and the revenue impact is unclear.

- The primary boost to state revenue will come from Oregonians paying less federal income taxes and therefore taking smaller federal tax subtractions. Oregonians, subject to some limits, can subtract their federal tax payments on their Oregon tax form. With these new tax breaks reducing federal tax liability in Oregon, Oregonians will owe a small amount more on their state taxes.

Unfortunately, the number of new tax policies potentially impacting Oregon’s tax code is immense. The items described above are only some of the possible impacts. While it’s too early to say how much revenue Oregon stands to lose, it’s safe to assume that it will add up to hundreds of millions of dollars. And Oregon would start losing revenue immediately after the bill is signed, given that some provisions — the overtime pay provision being one — are written to start in the current (2025) tax year.

In sum, this is a big, ugly bill that slashes health care and food from people in need to pay for tax cuts mainly for the rich. And it gets uglier still when you consider that it results in Oregon having fewer resources at a time when the state will be forced to pick up the slack created by the congressional abandonment of its prior commitments.

The Big Ugly: why the U.S. House bill means less health care, less nutrition assistance, and less state revenue

The Big Ugly: why the U.S. House bill means less health care, less nutrition assistance, and less state revenue

The Big Ugly: why the U.S. House bill means less health care, less nutrition assistance, and less state revenue

The reconciliation bill passed by the U.S. House ahead of Memorial Day is definitely big, taking up more than 1,000 pages. What’s in those pages, however, is truly ugly — a monstrosity. At its core, the package slashes health coverage and food assistance for struggling families to pay for tax cuts largely for the rich.

But for Oregonians, it’s even uglier. Because much of Oregon’s tax code is set up to mirror federal tax law, the House reconciliation bill would shrink state revenue collections at a time when the federal government would shift more of the costs of health care and nutrition assistance to the state.

Huge ugly bill leaves Oregonians hungry and sick . . .

Republicans in the House and Senate are working with President Trump to combine historically large cuts to health coverage and food assistance with a set of tax cuts that disproportionately help the wealthy. If enacted, this legislation will make Oregonians sicker and hungrier, while burdening the state with more of the cost of essential safety net programs.

. . . to pay for egregious tax cuts for the rich

The reason for these cuts is to offset the cost of renewing and expanding the upside-down tax cuts enacted in 2017 during the first Trump administration. Some of those tax cuts are set to expire at the end of the year. Instead of just renewing those tax cuts already favoring the most well-off, Congress is doubling down with a pile of new tax cuts.

Combining the old and new tax cuts shows exactly how upside-down these proposals are. The lowest-earning 20 percent of Oregonians, earning an average of $15,600 per year, would receive an average of $130 in tax cuts. The richest 1 percent of Oregonians, averaging $1.6 million in annual income, would get a tax cut averaging nearly $42,000.

Even benign-sounding tax provisions are damaging: the example of exempting overtime from taxation

While it is crucial to keep in mind that the tax package as a whole is flowing disproportionately to the rich, we can also look at some of the more specific tax provisions on their own.

One proposal in the House Budget Reconciliation is to exempt overtime income from taxation, a proposal that turns out to also be upside-down. While people may picture a middle-class worker when they hear overtime, the reality is more complicated. It’s estimated that the middle 20 percent of workers would average a $210 tax cut from the provision, while the richest 20 percent would average nearly five times as much, $940. Estimates for the lowest-earning 20 percent can be rounded to zero.

For this regressive tax cut, the federal government expects to lose more than $35 billion per year. To be clear, its poor targeting and high cost are only some of the many reasons to continue taxing overtime.

Oregon will pay the price for many bad tax provisions, unless the legislature acts

Oregon’s tax code automatically connects with parts of the federal tax code, meaning that tax changes at the federal tax level often become Oregon law without the Oregon legislature changing any state statutes. Oregon automatically copies wasteful federal tax cuts, unless the Oregon legislature passes a law to “disconnect” from those provisions.

Consider the prior example of exempting overtime income from income taxes. Current analyses forecast that Oregon would automatically connect to this policy and duplicate it in our tax code. One estimate of the revenue hit for Oregon is $322 million per year.

That’s a big loss of revenue. It’s roughly the same amount that policymakers say is needed every biennium to address wildfire prevention and protection, but which currently remains unfunded by the legislature.

And that is just one example among dozens of potential ways Oregon stands to lose revenue due to the big, ugly federal bill. Since the legislation is still being worked on and is expected to be changed significantly in the U.S. Senate, what follows is a high-level taster of potential risks for Oregon’s tax system:

To be fair, there are a small number of items that could provide additional revenue in Oregon:

Unfortunately, the number of new tax policies potentially impacting Oregon’s tax code is immense. The items described above are only some of the possible impacts. While it’s too early to say how much revenue Oregon stands to lose, it’s safe to assume that it will add up to hundreds of millions of dollars. And Oregon would start losing revenue immediately after the bill is signed, given that some provisions — the overtime pay provision being one — are written to start in the current (2025) tax year.

In sum, this is a big, ugly bill that slashes health care and food from people in need to pay for tax cuts mainly for the rich. And it gets uglier still when you consider that it results in Oregon having fewer resources at a time when the state will be forced to pick up the slack created by the congressional abandonment of its prior commitments.

Daniel Hauser

Action Plan for the People

How to Build Economic Justice in Oregon

relevant topics

The Data Tells a Different Story: Oregon’s Economy Has Grown Faster Than Most

HB 4136: Invest in homeownership by ending vacation home mortgage interest deduction

Oregon Child Care Crisis: How ERDC Running Out of Funds Could Hurt 12,000 Families

Action Plan for the People

How to Build Economic Justice in Oregon

Latest Posts

The Data Tells a Different Story: Oregon’s Economy Has Grown Faster Than Most

If you follow news coverage about Oregon’s economy, you may be surprised to learn the following: Oregon’s economy has grown

Testimony in Support of SJR 201

Chair Broadman, Vice-Chair McLane, and Members of the Committee, My name is Tyler Mac Innis, Policy Analyst for the Oregon

HB 4136: Invest in homeownership by ending vacation home mortgage interest deduction

Chair Nathanson, Vice-Chair Reschke, Vice-Chair Walters, and Members of the Committee, My name is Daniel Hauser, Deputy Director for the

Your donation helps build Economic Justice in Oregon

Your donation helps build Economic Justice in Oregon