The massive Republican tax and budget bill is a feast for the rich. The overwhelming majority of the tax breaks in the so-called One Big Beautiful Bill Act flow to the richest households and large corporations, paid for in part through deep cuts to health care for working families and food assistance for hungry families.

Seeking to rebrand this unpopular bill, the Trump administration has tried playing up some provisions supposedly benefiting working-class families, including exempting tips and overtime from income taxes. While those two tax provisions may sound nice, in reality, they are crumbs falling off the table where the rich feast.

Those who need help the most get very little tax benefit

The structural approach of exempting overtime and tips from taxation is a poor match for very low-income workers. Folks in the bottom 20 percent of income often don’t owe personal income taxes, even though they pay enough other taxes to end up devoting a greater share of their income in all taxes than the rich. Thus, for many low-income workers, a tax exclusion, deduction, or subtraction does not actually change their tax bill at all.

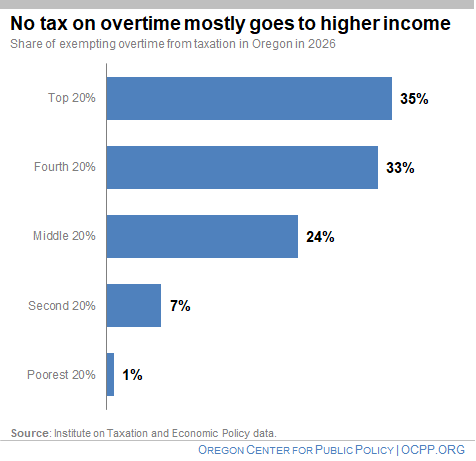

Take the case of exempting overtime pay. The poorest 20 percent of tax filers – those who most need a tax break – together get a measly 1 percent of the break. By contrast, the richest 20 percent of tax filers together collect about 35 percent of the tax benefits, more than any other income group.

One reason that the well-off benefit most from exempting overtime income from taxes, even though the benefit phases out starting at $300,000, is that the well-off earn higher base wages, giving them greater potential to benefit. Consider someone making $100 per hour. If they work 10 hours of overtime and receive time-and-a-half for that overtime, they net $1,500 in overtime pay. With the amount over the regular rate of pay being exempt from taxes, this worker gets $500 tax-free. For someone earning $20 an hour and also working 10 hours of overtime at time-and-a-half, their tax-exempt income is $100. Another reason is that the marginal income tax rate is higher for higher earners. Therefore, a $100 tax exemption for someone making $250,000 per year delivers a larger tax benefit than a $100 tax exemption for someone making only $30,000 per year.

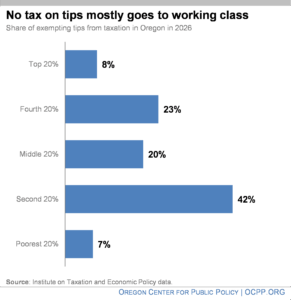

The tax benefit from the exclusion of tips from income taxes is more reasonably distributed. The bottom 20 percent receive less than the top 20 percent does, but the middle 60 percent captures 85 percent of the benefit.

A policy can be fair in its distribution, however, and still be flawed. That is the case here.

Exempting overtime and tips from taxes is rife with unfairness

Both the exemption on income from overtime and tips come with a big flaw: they treat one type of income differently from other types. Analysts from one side of the political spectrum to the other point out that this is a bad way to do tax policy, because it leads individuals and businesses to make economic decisions simply to get a tax benefit, rather than what makes most economic sense. But even worse, treating different forms of income differently inevitably leads to unfairness, where similarly situated taxpayers are treated differently.

In the case of overtime pay, a lot of workers who work long hours do not receive overtime pay. That’s likely the case with workers who cobble together multiple jobs to make ends meet. And it’s certainly the case with gig workers, such as Uber and Lyft drivers. Some salaried workers also do not qualify for overtime pay.

In the case of tips, few workers receive that type of income. Nationally, about 2.5 percent of workers receive tips. The exemption of tips from taxes does nothing for the vast majority of workers who earn similarly low levels of income, but not in the form of tips. Why should the person who brings you food at a restaurant get a tax break, but not the person who gives you food at the deli counter of the supermarket?

Treating different sources of income differently creates an incentive for special interests to seek to game the system. Already, the administration has declared social media influencers and comedians to be eligible for the tax break on tips. It’s likely just a matter of time before other occupations seek to be added to the list.

Oregon can deliver a better tax break

If lawmakers want to help working families, there is a better approach: strengthening the Oregon Earned Income Tax Credit. The EITC avoids the unfairness of exempting certain types of income from taxes but not others, delivering a refundable tax credit to working families regardless of how they earn their pay. Since it’s a refundable tax credit instead of a tax exclusion, it avoids the problem of very low-income workers not benefiting. An increase in Oregon’s EITC would deliver all the benefits to the bottom 60 percent, with half to the bottom 20 percent. At a time when so many families are struggling financially, that’s a solution that makes sense.

We can’t let the rich distract us with crumbs while they feast.

Tax breaks for tips and overtime are crumbs for the working class

Tax breaks for tips and overtime are crumbs for the working class

Tax breaks for tips and overtime are crumbs for the working class

The massive Republican tax and budget bill is a feast for the rich. The overwhelming majority of the tax breaks in the so-called One Big Beautiful Bill Act flow to the richest households and large corporations, paid for in part through deep cuts to health care for working families and food assistance for hungry families.

Seeking to rebrand this unpopular bill, the Trump administration has tried playing up some provisions supposedly benefiting working-class families, including exempting tips and overtime from income taxes. While those two tax provisions may sound nice, in reality, they are crumbs falling off the table where the rich feast.

Those who need help the most get very little tax benefit

The structural approach of exempting overtime and tips from taxation is a poor match for very low-income workers. Folks in the bottom 20 percent of income often don’t owe personal income taxes, even though they pay enough other taxes to end up devoting a greater share of their income in all taxes than the rich. Thus, for many low-income workers, a tax exclusion, deduction, or subtraction does not actually change their tax bill at all.

Take the case of exempting overtime pay. The poorest 20 percent of tax filers – those who most need a tax break – together get a measly 1 percent of the break. By contrast, the richest 20 percent of tax filers together collect about 35 percent of the tax benefits, more than any other income group.

One reason that the well-off benefit most from exempting overtime income from taxes, even though the benefit phases out starting at $300,000, is that the well-off earn higher base wages, giving them greater potential to benefit. Consider someone making $100 per hour. If they work 10 hours of overtime and receive time-and-a-half for that overtime, they net $1,500 in overtime pay. With the amount over the regular rate of pay being exempt from taxes, this worker gets $500 tax-free. For someone earning $20 an hour and also working 10 hours of overtime at time-and-a-half, their tax-exempt income is $100. Another reason is that the marginal income tax rate is higher for higher earners. Therefore, a $100 tax exemption for someone making $250,000 per year delivers a larger tax benefit than a $100 tax exemption for someone making only $30,000 per year.

The tax benefit from the exclusion of tips from income taxes is more reasonably distributed. The bottom 20 percent receive less than the top 20 percent does, but the middle 60 percent captures 85 percent of the benefit.

A policy can be fair in its distribution, however, and still be flawed. That is the case here.

Exempting overtime and tips from taxes is rife with unfairness

Both the exemption on income from overtime and tips come with a big flaw: they treat one type of income differently from other types. Analysts from one side of the political spectrum to the other point out that this is a bad way to do tax policy, because it leads individuals and businesses to make economic decisions simply to get a tax benefit, rather than what makes most economic sense. But even worse, treating different forms of income differently inevitably leads to unfairness, where similarly situated taxpayers are treated differently.

In the case of overtime pay, a lot of workers who work long hours do not receive overtime pay. That’s likely the case with workers who cobble together multiple jobs to make ends meet. And it’s certainly the case with gig workers, such as Uber and Lyft drivers. Some salaried workers also do not qualify for overtime pay.

In the case of tips, few workers receive that type of income. Nationally, about 2.5 percent of workers receive tips. The exemption of tips from taxes does nothing for the vast majority of workers who earn similarly low levels of income, but not in the form of tips. Why should the person who brings you food at a restaurant get a tax break, but not the person who gives you food at the deli counter of the supermarket?

Treating different sources of income differently creates an incentive for special interests to seek to game the system. Already, the administration has declared social media influencers and comedians to be eligible for the tax break on tips. It’s likely just a matter of time before other occupations seek to be added to the list.

Oregon can deliver a better tax break

If lawmakers want to help working families, there is a better approach: strengthening the Oregon Earned Income Tax Credit. The EITC avoids the unfairness of exempting certain types of income from taxes but not others, delivering a refundable tax credit to working families regardless of how they earn their pay. Since it’s a refundable tax credit instead of a tax exclusion, it avoids the problem of very low-income workers not benefiting. An increase in Oregon’s EITC would deliver all the benefits to the bottom 60 percent, with half to the bottom 20 percent. At a time when so many families are struggling financially, that’s a solution that makes sense.

We can’t let the rich distract us with crumbs while they feast.

Daniel Hauser

Action Plan for the People

How to Build Economic Justice in Oregon

relevant topics

HB 4136: Invest in homeownership by ending vacation home mortgage interest deduction

Oregon Child Care Crisis: How ERDC Running Out of Funds Could Hurt 12,000 Families

7 Things to Know About Oregon’s Estate Tax

Action Plan for the People

How to Build Economic Justice in Oregon

Latest Posts

Testimony in Support of SJR 201

Chair Broadman, Vice-Chair McLane, and Members of the Committee, My name is Tyler Mac Innis, Policy Analyst for the Oregon

HB 4136: Invest in homeownership by ending vacation home mortgage interest deduction

Chair Nathanson, Vice-Chair Reschke, Vice-Chair Walters, and Members of the Committee, My name is Daniel Hauser, Deputy Director for the

SB 1586: Do not create a new manufacturing tax credit

Chair Broadman, Vice-Chair McLane, and Members of the Committee, My name is Daniel Hauser, Deputy Director for the Oregon Center

Your donation helps build Economic Justice in Oregon

Your donation helps build Economic Justice in Oregon