No, the superrich do not need a bigger tax break.

And yet, unless the Oregon legislature steps in, Oregonians will get stuck with paying for one that goes almost exclusively to rich investors making over a million dollars a year. Oregonians will pay for this massive tax break for the rich by getting fewer resources for schools, health care, and other services families count on.

That tax break, the Qualified Small Business Stock (QSBS) exclusion, has been part of Oregon’s tax code for some time, but now its price tag will be supercharged. The budget bill passed by the Republican majority in Congress, known as H.R. 1 or the One Big Beautiful Bill Act, made QSBS even more generous to rich investors. Because Oregon automatically replicates many federal tax changes, the state has also copied this more costly version.

QSBS was indefensible before this expansion, and it’s worse now. The Oregon legislature needs to pull the plug on QSBS.

QSBS is a tax break for very rich investors

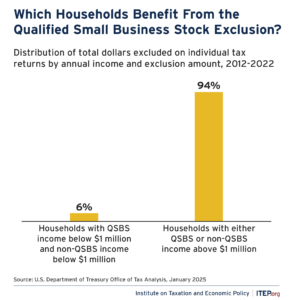

There’s no getting around the fact that QSBS is a tax break for rich investors, benefiting corporate founders and venture capitalists. Instead of helping the small businesses it was intended to support, the tax break has been a boon for investors in big tech corporations such as Uber, Zoom, and Airbnb. QSBS “operates as a de facto subsidy” for the venture capital industry, which includes many of the richest people in the country. It’s no wonder that about 94 percent of the tax benefits from QSBS go to households with more than $1 million in annual income.

The way QSBS works is that it allows certain investors to avoid paying taxes on all or part of the profits made when selling the stock of a qualifying corporation. The tax break is for people who invested in a C-corporation when the company originally issued stock. The C-corporation must meet certain criteria. For instance, the company must have had less than $75 million in assets ($50 million before the recent congressional change) when the stock was issued, and must not be in industries such as law or finance.

As long as the criteria are met and the investor has held the stock for at least five years, the investor can avoid all taxes on up to $15 million of profits ($10 million before this year), or 10 times the investor’s original investment, whichever is greater. If the investor held the stock for less than five years, but at least three years, they get a partial tax break, still shielding a portion of their profits from taxation.

Not content with pocketing the huge tax break that Congress gave them, the superrich have further gamed the QSBS tax loophole. Through complex tax planning schemes, rich investors multiply the tax benefits from QSBS across businesses, family members, and trusts. As the New York Times reported a few years back, “[t]hanks to the ingenuity of the tax-avoidance industry, investors in hot tech companies are exponentially enlarging the tax break.”

The phrase “Small Business” puts the B.S. in QSBS

QSBS is not a tax break for mom-and-pop shops or anything that most people would consider a “small business.” To qualify for the tax break, the investor must invest in a C-corporation, the kind of corporation that is taxed at the business level. The overwhelming majority of small businesses, however, are businesses that “pass-through” their profits on to individual income taxes. Pass-through entities include sole proprietorships, partnerships, or limited liability corporations, but not C-corporations.

QSBS has been costly, and the price tag is about to grow

In July, the Republican majority in Congress made QSBS even more generous by making bigger corporations eligible and increasing the profits each investor can keep tax-free.

These changes mean that the national price tag of QSBS will grow to about $80 billion over the next decade. A similar dynamic will be seen here in Oregon, where the current cost is about $75 to $80 million each budget period. That’s a significant amount of money — equal to the cost of doubling the Oregon Kids’ Credit, a targeted program that lifts thousands of children out of poverty every year. Although it is currently unclear how much more money Oregon will lose to the expanded QSBS, what is clear is that it’s set to balloon.

The case for QSBS is weak, and even weaker in the case of Oregon

The utility of QSBS is highly questionable. The venture capital industry, the main beneficiary of the tax break, has been flush with cash for years. With venture capitalists holding more money than they know what to do with, giving them a huge tax break is pure waste. As one observer put it, “there is no evidence that [QSBS] is encouraging investment that would not have occurred in its absence.”

The rationale for Oregon to subsidize venture capital is even weaker. Consider a venture capitalist in Portland who invests in a start-up in California or New York. They will receive the QSBS tax break on their Oregon income taxes. Even if one assumes that the investment would not have occurred in the absence of the tax break, a dubious claim, that investment would produce no boost to Oregon’s economy. And yet Oregon’s revenue would fall as a result.

One might logically think Oregon should limit the benefit to Oregon businesses, but that won’t work. California tried that, but the courts ruled it was unconstitutional, so California eliminated the tax break entirely. Oregon should do the same.

Oregon’s tax break for QSBS is a mistake that is about to get more costly. It’s time for the legislature to pull the plug on this tax break for rich investors.