The massive reconciliation bill passed by Congress on the eve of the 4th of July holiday will leave many Oregon families less healthy, hungrier, and poorer. In this episode of Policy for the People, we discuss the implications of this disastrous bill.

Listen to prior episodes of the show

Transcript

We make this transcript available for your convenience and to increase the accessibility of our content. The transcript was generated by software and was slightly edited for clarity. If you are able to, we encourage you to listen to the recording.

It’s hard to overstate the danger that lies ahead for many families in Oregon and across the country, especially the families already struggling the most to stay afloat economically.

On the eve of the July 4th holiday, Congress passed a massive reconciliation package, signed into law by President Trump the following day. It’s a historic piece of legislation, but for all the wrong reasons. At its core, the reconciliation bill, the so-called One Big Beautiful Bill, is a massive set of tax cuts that mainly flow to the rich, paired with cuts to health care and nutrition assistance that help struggling families make ends meet.

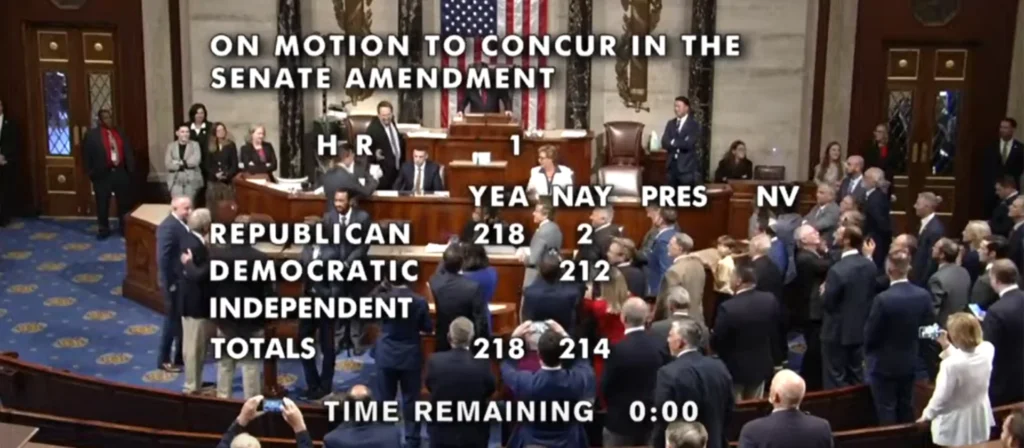

As the U.S. House of Representatives was taking its final vote on the bill, the version already approved by the Senate, I spoke with my colleague from the Oregon Center for Public Policy, Tyler Mac Innis, a policy analyst at the Center. As Tyler explains, the reconciliation bill that is now law will leave many Oregon families less healthy, hungrier and poorer.

Here’s my conversation with Tyler Mac Innis on the implications of the reconciliation bill.

Juan Carlos Ordóñez (host): Hi, Tyler. How are you?

Tyler Mac Innis: I’m doing okay. Juan Carlos, are you?

Juan Carlos: I’m doing as well as could be expected, given what’s happening in Congress right now. As we’re speaking, Congress is on the edge of voting for the so-called One Big Beautiful Bill, a bill that threatens significant damage to Oregon families, according to an article that you wrote recently. Is that correct?

Tyler: That’s correct. The bill that is moving through Congress right now will be incredibly harmful to Oregon families.

Juan Carlos: So what’s the bottom line? You’ve looked at the bill. You’ve written about it. What is your bottom line assessment of this massive piece of legislation?

Tyler: Yeah. Well, this reconciliation package is going to be incredibly damaging for Oregon families and for families across the country. They stand to lose health care, nutrition assistance and cash supports. So, in other words, this bill will make Oregon families less healthy, hungrier and poorer.

And I think it’s important to note that all of this is happening because congressional Republicans are looking to shower the wealthy with lavish tax cuts and to expand the Trump administration’s deportation efforts. And so altogether, this package is a really, really bad deal for Oregon families. And it will be incredibly harmful for our communities.

Juan Carlos: Some of the listeners may already know what’s in the budget reconciliation bill, but for those who don’t, can you give us a quick recap of what’s in this legislation?

Tyler: So I think to start, it’d be helpful to take a quick step back in time to 2017. And that was during the first Trump administration when Congress passed what’s called the Tax Cuts and Jobs Act. And listeners may know that as the Trump tax cuts. There was a massive package of tax cuts, both for corporations and for individuals. And that piece of legislation made the corporate tax cuts permanent. But the individual tax cuts in that package were set to expire in 2025. And so that’s why now we’re seeing Congress take up this new reconciliation package.

So the new reconciliation package, the one that’s moving through Congress as we speak, is looking to renew some of those tax cuts in the TCJA. It’s looking to create new ones and expand on some of the ones that were in the TCJA. And altogether, we’re talking about trillions of dollars worth of tax cuts, disproportionately to the wealthy over the next decade.

And so to mitigate that costs, the Republican plan looks to make deep cuts to social safety net programs that Oregonians rely on to get by, things they need to access their health care to keep food on the table, or to just have some extra cash in their families budgets. And so there’s so much harm littered throughout this package. But those cuts to health care, to food assistance and to cash supports are going to be especially damaging to Oregon families.

Juan Carlos: So I want to get into the specifics of the bill, drill down on some of the things that you’ve mentioned already. But before we get to that, I wonder if you can paint for us the context in which this bill is arriving. How are Oregon families doing right now economically? Just so we can get a baseline assessment of how this bill is going to impact families.

Tyler: I would say that there is a large share of Oregon households and across the country, for that matter, that are struggling economically now. They’re having a really hard time getting by if they’re able to get by at all. There’s a lot of different ways you can try to get at answering this question, and there’s all sorts of analyzes that are out there. One that we tend to look to at the Oregon Center for Public Policy is something called the ALICE index. And this is an analysis that’s put together by the United Way. ALICE is an acronym that stands for Asset limited, Income constrained and Employed.

And what the ALICE index attempts to figure out is what a family needs to meet its basic needs. It calls it the survival budget. That’s the bare minimum that a family needs to live and to work and get by in today’s economy. So it looks at things like the cost of housing, childcare, transportation, food, health care, etc..

And according to the most recent ALICE figures, in 2022, there were about 45% of Oregon households who were not making enough money to meet that survival budget threshold. So we’re talking about more than 2 in 5 families in Oregon, every 2 in 5 families failing to meet that basic baseline for a standard of living.

So I think the bottom line here is that there is a big chunk of Oregon families and families across the country, for that matter, because we are not unique in this respect, that are already struggling to get by. And this bill does little to nothing to help them.

Juan Carlos: As you said, the main takeaway is that the bill threatens the economic well-being of families. How does the bill do that?

Tyler: Well, the bill does that in a number of ways. And I think I’ll start maybe by talking about how it harms the health of families. The bill that’s moving through Congress attempts to offset the cost of those trillions of dollars of tax cuts, first, by making cuts to Medicaid, trying to take away health care from the poorest of families. And it’s attempting to find hundreds of billions of dollars worth of savings in this way.

It achieves this by establishing work requirements for families who are receiving Medicaid. And these, in practice, are really layers of red tape and bureaucracy that families have to navigate in order to show that they are deserving of accessing health care through the program.

I think it’s important to note for listeners that today in Oregon, about 9 in 10 Oregonians who are receiving Medicaid are either already working or they meet an exemption from work requirements. And those exemptions are, usually, that they’re taking care of a family member at home, or that they themselves are ill or disabled, or they’re going to school. And so if everyone more or less currently on Medicaid is either meeting work requirements or would fulfill one of these exemptions, how does this plan find hundreds of billions of dollars worth of savings.

And the answer is it’s forcing people to regularly fill out paperwork to prove that they are deserving of accessing health care under this program. And it creates all sorts of bureaucratic obstacles for families to access their care. And this isn’t hypothetical. States have tried this in recent history, and we know that in practice, what happens is families that should be able to continue to access Medicaid are kicked off the rolls because of these layers of red tape that are put up in front of them

And so we’ve seen some estimates that there are hundreds of thousands of Oregonians who stand to lose their health care as a result of this plan and these layers of red tape that they’re going to have to navigate. There are other ways. We could do a whole show on the ways in this bill could harm the health of Oregon families.

But another really important one to note is that this legislation takes away support for families who are accessing their health insurance through the health care exchanges that were established under the Affordable Care Act. It essentially raises the cost of affording health care on the exchange. And so families who were previously able to purchase health care coverage on one of the exchanges may no longer be able to do so. So it’s raising the cost of just accessing health care for families on the exchanges.

The Congressional Budget Office, these are the nonpartisan analysts for Congress, they’ve looked at this reconciliation package and they’ve estimated that over the next decade, some 17 million Americans are going to lose their health insurance coverage as a result of this reconciliation bill that’s steamrolling through Congress right now.

So there’s no way around it. It’s a horrible bill from the perspective of ensuring that everyone has access to the health care that they need.

Juan Carlos: As you’re saying, millions of people across the country will be losing their health care. There’s also the issue of food security and food assistance. You said that the bill threatens to take away food from families. How does it do that?

Tyler: Through many of the same mechanisms. Again, this package is throwing up layers of red tape that’s going to make it harder for families to feed their children.

The so-called One Big Beautiful Bill is seeking to impose work requirements on families who have kids as young as seven years old. That’s going to take food off their dining room table. And again, this is so that we can afford tax cuts that are disproportionately going to the wealthy. When we look at the data, we see that most of the people who are receiving food assistance in Oregon and in the US who are able to work are already working.

So these are just draconian measures that are aimed at making life more difficult for families who just need a little bit of extra help to keep food on the table, to keep their families fed. The way work requirements currently work in current laws, they are imposed on what are called able bodied adults without dependents or ABAWDs.It’s one of the worst acronyms in public policy. But someone who is an adult without dependents, who is so-called able bodied, they are limited to three months of benefits in every three-year window, unless they can show that they are meeting certain work requirements. And what this bill would do is expand those work requirements to families with kids as young as seven.

The plan also shifts some of the costs of administering the program, paying for the program itself, on to states. And if a state can’t pick up that tab, they have two choices in front of them. They have to either make cuts to their SNAP roles to remove people or remove families from the program, or they can opt out of SNAP altogether.

I would hope, and I think, Oregon is not one of the states that would opt out of snap entirely. But we might see that in some parts of the country, which is incredibly devastating for families who live in those states. I think it’s also important to note that when school-age kids are cut off from SNAP rolls, they lose automatic enrollment and free school meals in summer programs.

So as a result, this bill is also cutting federal spending on school lunches and breakfasts and summer meals programs. And there are analyzes out there that show that this is going to impact hundreds of thousands of kids in an average month going forward, when it becomes law. And so again, this is just incredibly devastating, the harm that this bill will inflict on families who are just trying to make ends meet.

Juan Carlos: It reminds me of a conversation I had recently with Andrea Williams, who is the President of the Oregon Food Bank, and she highlighted just the extent of demand that they’re seeing right now at food banks across the state. And so it seems like this is just it’s going to be hitting families at a time when they’re really vulnerable when it comes to their food security,

Tyler: Something that is a through-line in this bill is that whether you look at health insurance impacts, or impacts to food assistance, or other parts of the bill that we’ll talk about I’m sure in a moment, the approach that this bill takes is exactly opposite of what families need right now.

It does nothing to help families who are struggling to get by, regardless of which aspect of the bill you’re looking at. It’s just incredibly damaging.

Juan Carlos: You also mentioned that the bill takes away cash support from families. Talk to us about that.

Tyler: Yeah. So specifically, we’re talking about the child tax credit. And I’ll talk in a moment about how it actually takes cash away from some families.

But let’s start by talking about what a missed opportunity there was here on the CTC. The child tax credit is a tax credit that’s available to working families at the federal level. And it provides families with some extra cash at the end of the year when they go to file their taxes. If we go back in time, just a few years ago, there was an effort to expand the federal CTC in 2021 under the American Rescue Plan. We expanded the CTC for a period of time. And we made a couple really important changes to that program that had incredible impacts, improving the well-being of families across the country.

We made it fully available to the lowest income families in the country, and we started paying out a portion of the CTC on a monthly basis to help families with their monthly grocery bills or the utility bills, what have you. And what we saw from just those simple policy changes was child poverty across the country cut in half seemingly overnight. We saw just tremendous impacts from these changes to the CTC. But unfortunately, those changes were temporary. They expired at the end of 2021. And so from 2021 to 2022, we saw the largest increase in child poverty, across the country in decades. And so there was a huge opportunity in this package to take those lessons from just a few years ago.

We know what works when it comes to making the CTC work better for families. And yet again, Congress is failing to take those lessons and include them in this package that’s moving through the halls of Congress right now. So the reconciliation package fails to expand the CTC to the families with the lowest incomes.

So despite the fact that it does increase by a few hundred dollars the amount of a child tax credit per child for families who are able to claim it, there are nearly 170,000 children in Oregon who will see little to no benefit because their families don’t earn enough money to claim, either any or the full value of the CTC.

So you know, this plan shuts out those children from that benefit. It also strips eligibility from families who have a parent filing with an Individual Taxpayer Identification Number. An ITIN number, some people may have heard it referred to. And these are people who are doing their due diligence, paying their taxes, fulfilling their civic duty on behalf of their families.

But they use an ITIN number as opposed to a Social Security number because they themselves are not citizens. Their kids might be citizens or a lawful, permanent resident. But this bill would strip the CTC from those families because one of their parents is using an ITIN number instead of a Social Security number. So, again, this is just incredibly harmful policy that does nothing to help families who are struggling the most to get by.

Juan Carlos: At the same time that this massive piece of legislation takes away cash supports from some families, and it doesn’t really do justice to what it could do in terms of strengthening the child tax credit, it’s giving massive tax cuts to the very wealthy in our country. Give us a sense of how extreme the tax plan here is.

Tyler: Yeah, extreme is the right word for it. The Senate bill, which seems to be the version that is likely to move here, has dozens of tax provisions, including all sorts of cuts to personal income taxes and corporate tax cuts. So the package is crammed full of all sorts of different tax cuts and changes to the tax code.

The Institute on Taxation and Economic Policy has run the numbers on the whole package, on who gets what from it. And looking at their analysis, when you add up all the tax provisions in this package, what you find is that the richest 20% of people in the country are together getting about 72% of all the tax cuts, all the tax benefits from this plan.

And it’s even more skewed when you look at the tax benefits that are just going to people at the very top. So the richest 1% of Americans, and these are people who are making roughly $920,000 a year or more, they together receive about $117 billion worth of tax cuts in 2026. That’s more than the bottom 60% of all Americans combined will collect that group. The bottom 60% will take home about $77 billion.

So we’re seeing incredible disproportionality in terms of the amount of dollars that’s flowing to the folks at the very top. Another way of looking at it is the dollar amounts that the individual household stands to receive under this plan. And again, that really shows us how out of whack this whole package is. In this case, the Institute on Taxation and Economic Policy has looked at that at the state level. And so we can talk specifically here about Oregon households.

And so according to their analysis, the richest 1% of Oregonians, so the richest one in every 100 Oregonians, will take home on average about $40,000 as a result of this bill. That $40,000 tax cut that the average member of the 1% in Oregon will get is more than the income that many Oregon families are earning in a single year.

And we can also compare that to the tax benefits that households in the bottom 20% of Oregonians would get. And these are households that are making less than $28,000 a year. In that group, the bottom 20% stands to get about $17. That’s just a little bit more than what a minimum wage worker in Oregon earns on an hourly basis.

So you have families who are struggling the most in Oregon; they get 17 bucks. And you get a household in the top 1% in Oregon that walks away with $40,000. So there’s no way to sugarcoat this plan. It’s incredibly out of whack. And it does nothing to help families who are struggling the most in our state.

Juan Carlos: You mentioned earlier that 45% of all households in Oregon are having a hard time making ends meet. You referenced the ALICE index that the United Way puts out. And that’s their estimate, that roughly 45%, more than two out of five, Oregonians, are struggling. Is there a way to assess the impact that this reconciliation bill will have on that subset of Oregonians, that group that is struggling the most?

Tyler: I think that’s a really key question here. And I think that’s ultimately like what the piece that I put out recently was attempting to get at. And unfortunately, the answer is that the families that are struggling the most, the families that we’re talking about when we’re talking about the 45% who are failing to meet a basic survival budget in Oregon, these families are made worse off as a result of this reconciliation bill.

When you look at all the tax cuts and where the benefits flow, when you look at the cuts to things like Medicaid, SNAP, the CTC and these things that we’ve been talking about, all of these things together, what you see is the families who are already struggling the most are made worse off as a result of this reconciliation package.

And it’s not just us saying that. The Yale Budget Lab is a group that has analyzed the totality of this package. They’ve looked at the tax cuts and they’ve looked at the impacts that families will see as a result of these cuts to social safety net programs. And what the Yale Budget Lab published just a few days ago shows that the bottom 40% of American families are net worse off as a result of this reconciliation package.

So that’s almost exactly the same as the 45% of Oregon families who are already struggling the most to get by. And so I think, again, we just see this package does nothing to help the families in our state who are struggling. All it stands to do is to make them less healthy, hungrier and poorer. And so it’s an incredibly bad deal for those families, and it’s incredibly damaging for Oregon.

Juan Carlos: I wonder if you can explain what you mean when you say that they’re net worse off. How does that math work out?

Tyler: If we consider the we talked earlier about the tax implications under this bill, we talked about the families at the very bottom standing to see a $17 tax cut, as opposed to the folks at the very top. Now take into consideration that family might be losing their SNAP benefits. So the cost of putting food on the table for that family goes up. Perhaps they lose their Medicaid coverage. Or if they’re purchasing health insurance on one of the ACA exchanges, the cost of affording that health care has now gone up.

So when you look at the totality of these things, the fact that they aren’t getting significant tax cuts under this plan and just affording the basics is going to be made that much more expensive for them, they’re in a net worse off position relative to where they started before this bill started making its way through Congress.

Juan Carlos: We mentioned at the beginning that we are speaking on the eve of the final vote by the House on this bill. So it could be that by the time that this recording gets published, this legislation will be a reality. I wonder what you think this means in the long term, in terms of what Oregonians should be thinking and doing in response to this legislation, what the Oregon Legislature could do in this respect, and as a nation, what we may be thinking down the road.

Tyler: We’ve just scratched the surface in terms of discussing the harm that this package is going to do. So thinking about what needs to be done to make up the ground that we’re losing under this package, to mitigate the harm that’s going to be happening as a result of this package, that’s an extensive conversation. I don’t think we can fully capture what needs to happen in this conversation here. I do think, though, that at the state level, we are going to be seeing families struggling to get by as a result of these cuts to Medicaid and SNAP, CTC and the like.

And so at the state level, we need lawmakers to be showing courage, to be thinking in big and bold ways and thinking about how we can fill the gaps that are going to be created by these cuts at the federal level. So we need to be looking at things like raising revenue to make sure that no one loses their health insurance or their food assistance. We need to be looking at expanding things like the Oregon Kids’ Credit that provides a state level version of the child tax credit to all to the lowest income families in Oregon.

We need to be doing so many things at the state level to mitigate the harm that’s coming from this federal package. And so we need lawmakers to be bold. We need Oregonians to hold our state and our federal lawmakers to account, and to make sure that we are putting forward public policies that are thinking about the families that we’ve been talking about in this conversation.

You know, the families who are struggling the most in our economy today need to be the central focus of our policy work. And so we need to be thinking about how we are going to ensure that those families are able to meet their basic needs, and that Oregon is a good place for them to raise their families.