Big multinational corporations have long manipulated the tax system to avoid paying their fair share. Correcting this unfairness is all the more urgent right now, as Oregon grapples with the loss of nearly $900 million in revenue already budgeted for schools and other essential services due in part to new corporate tax breaks manufactured by Congress.

One great step Oregon can take to confront the problem is by dealing with two policies that affect how multinational corporations are taxed: Foreign-Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI). By reforming these two corporate tax policies, Oregon can plug about $190 million of the revenue loss this budget period.[1] While more is needed, every dollar raised from global corporations is a dollar that is no longer at risk of being cut from schools, health care, or other essential services.

Multinational corporations play games with the tax system

For too long, corporations have manipulated the tax system, lobbying for new tax breaks and using their armies of accountants and lawyers to find new ways to exploit those tax loopholes. Over the past four decades, the portion of income taxes paid by corporations, as opposed to the portion paid by individuals and families, has fallen significantly. Further evidence of the tax tricks corporations play is that the last four decades have seen corporate profits far outpace corporate income tax payments.

One key strategy that corporations use to shrink their tax bills involves artificially shifting profits from where they were actually earned to a foreign tax haven, a place that levies little or no corporate income tax. For example, Big Pharma Corp. transfers its patent for a blockbuster drug to a subsidiary in the Cayman Islands, a notorious tax haven. The subsidiary then charges a hefty licensing fee to the company’s subsidiaries that actually sell the drug in the U.S. and Oregon. Through this scheme, Big Pharma Corp. artificially shifts profits earned in the U.S. and Oregon to the Cayman Islands, thereby avoiding taxes.

Recent federal reforms have failed to deter corporate tax avoidance by multinational corporations

During the first Trump administration, Congress made big changes to how multinational corporations are taxed. Under the 2017 Tax Cuts and Jobs Act, corporations are no longer required to include income from foreign subsidiaries in their federal or state income tax returns. At the same time, the new law established a carrot and stick approach to reduce the incentive of corporations to artificially shift profits to foreign subsidiaries.

The carrot is Foreign-Derived Intangible Income (FDII), which offers a tax deduction to corporations that keep intangibles, such as patents, in the U.S. while exporting goods to other countries.

The “stick” is Global Intangible Low-Taxed Income (GILTI), which is effectively a minimum tax on profits earned abroad that exceed a “normal” return, an indication that these profits are the result of tax avoidance strategies. If GILTI is triggered, 50 percent of those suspicious foreign profits are added to the corporation’s taxable income in the U.S.

These reforms appear to have failed to curb offshore corporate tax avoidance and possibly have made it worse. Since the enactment of the Tax Cuts and Jobs Act (TCJA), the largest and most profitable corporations saw profits rise by 44 percent, but their federal tax bills dropped by 16 percent. As one expert on corporate tax policy noted, “offshoring and profit shifting remain a serious problem after TCJA,” with U.S. multinationals continuing “to report substantial income in the lowest-tax locations, much as they had in prior years.” Other experts point out that the law created new incentives to shift profits outside of the U.S.

Oregon’s versions of FDII and GILTI have been costing the state a lot of money

Under a policy known as “rolling reconnect,” Oregon’s tax code automatically replicates many changes in the federal tax code. As a result, new corporate tax breaks created by Congress often become state law automatically. It takes a vote by the Oregon legislature to “disconnect” from federal law to prevent those tax breaks from becoming part of the Oregon tax code. As a result of rolling reconnect and Oregon’s legislative restructuring of multinational corporate taxation in 2018, FDII and GILTI became part of Oregon’s tax code.

Subsequently, Oregon lawmakers implemented GILTI in a complicated way due to the interplay of federal and state law. Functionally, Oregon requires corporations to include 100 percent of GILTI in their Oregon taxable income, but then allows corporations to claim an 80 percent tax deduction for that income. The net effect is that only 20 percent of GILTI is taxed in Oregon, far less than the 50 percent corporations must include in their federal tax returns or returns in 11 other states and the District of Columbia.

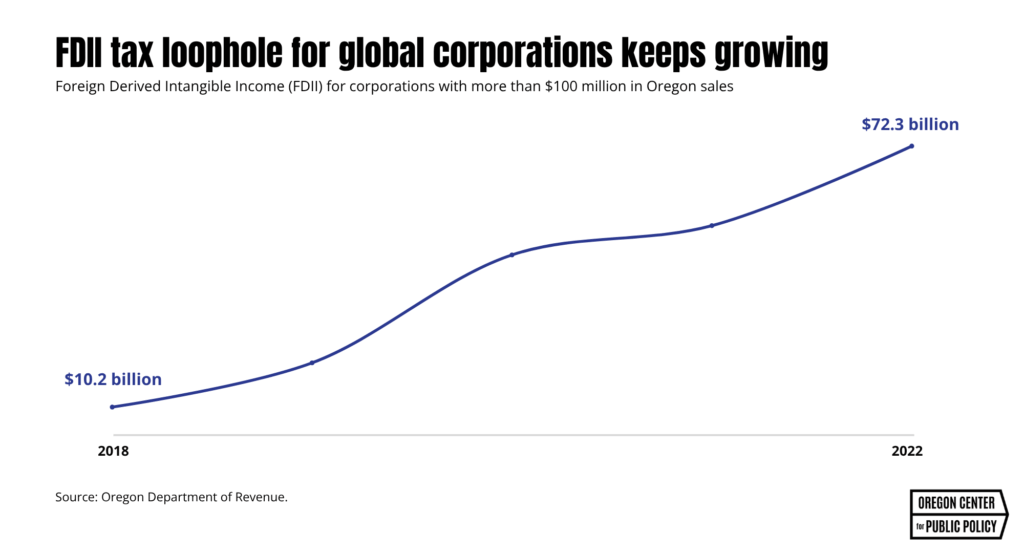

FDII has been a significant drag on state and federal revenues, with the benefits concentrated in a relatively small number of huge, global corporations. Federal estimates indicate that 15 companies have each received more than a billion dollars in federal FDII tax benefits since 2018. Corporations with more than $100 million in Oregon sales have received half or more of FDII during the last three tax years for which data is available. [2] This amount has been growing every year since the policy was enacted, reaching over $70 billion in federal FDII identified on Oregon returns in the 2022 tax year. Due to Oregon’s automatic connection to this policy, Oregon lost about $120 million in revenue in the 2023-2025 budget. These funds could have funded core services like childcare and housing, but instead flowed into the pockets of global corporations.

Similarly, the benefits of GILTI have been concentrated at the top. Data from the IRS indicates that large corporations with more than $500 million in assets claimed nearly 98 percent of GILTI. The amount of GILTI identified on Oregon income taxes totaled nearly $500 billion in the 2022 tax year.[3] This is the federal GILTI reported by corporations that have to file taxes in Oregon; the actual amount of corporate income actually subject to taxation in Oregon is a fraction of that.

Congress recently made corporate taxation more generous, and so far, Oregon is going along with this scheme

In July of this year, the Trump administration and Congress changed FDII and GILTI as part of their massive tax and budget package that slashed taxes for the rich and corporations. Part of the change involved renaming these tax provisions: FDII is now called Foreign-Derived Deduction Eligible Income (FDDEI), and GILTI is now Net Controlled Foreign Corporation-Tested Income (NCTI).

The most important change to FDII/FDDEI is that a significant reduction in the size of the tax deduction that was scheduled to take effect won’t happen. Instead, the deduction will only decrease a small amount. The bottom line is that, going forward, this tax loophole will cost more in lost revenue than it was supposed to when originally enacted in 2017.

The congressional tax and budget bill also made several modifications to GILTI, now NCTI. One of them was to cancel a change set to take effect that would have made GILTI less favorable for corporations, a change that would have increased the amount of suspicious foreign profits corporations would have to include in their U.S. tax returns from 50 percent to 62.5 percent. Instead, the new law set the amount of the increase to 60 percent. The law also eliminated a former provision allowing a 10 percent return on physical assets, and the foreign tax credit moved up to 90 percent. While complicated, the result will still be large sums of foregone federal and state revenue.

These changes to both FDII/FDDEI and GILTI/NCTI have become part of Oregon law, due to rolling reconnect. So, unless the Oregon legislature takes action, Oregon will lose even more revenue to these corporate tax loopholes going forward.

Solution: Drop FDII/FDDEI, stiffen GILTI/NCTI

The fact that Oregon is losing so much revenue to global corporations that play tricks with the tax system is a policy choice. It doesn’t have to be that way. Oregon can stem the loss of revenue by disconnecting entirely from FDII/FDDEI, the carrot that lures no one, and reforming GILTI/NCTI, strengthening the stick for deterring offshore tax avoidance.

Disconnect from FDII/FDDEI, the carrot that lures no one

Regardless of whether one thinks it’s a good idea for the federal government to reward multinational corporations that keep their intellectual property in the U.S., rather than shifting it to a foreign tax haven, it makes no sense for Oregon to double down on this policy. A company that moves a patent from the Cayman Islands to Nevada could see FDII/FDDEI lower its Oregon tax bill. No part of that transaction benefits the Oregon economy. The only result is that Oregon loses revenue it otherwise would collect.

The solution to this situation is simple: Oregon should disconnect from FDII/FDDEI. It should entirely reject the policy. That is what Colorado did recently, and Oregon would do well to follow that example.

If Oregon disconnected from FDII/FDDEI for the 2026 tax year, it would yield an estimated $67 million, or about $135 million for a full two-year budget period, in tax payments from multinational corporations.[4]

Turn GILTI/NCTI into a bigger stick than it currently is for Oregon

As noted above, Oregon’s version of GILTI is much weaker than the federal version. Presently, Oregon effectively requires multinational corporations to include 20 percent of suspicious foreign profits in their Oregon tax returns. This is a lot less than the 50 percent required by the federal version of GILTI before the recent changes, and even less than the 60 percent now required by NCTI (the new GILTI).

Oregon should significantly increase the amount of GILTI/NCTI that multinational corporations must include in their state tax returns. Some legal experts argue that states should require the same 60 percent level that the federal government mandates. Presently, nearly a dozen states require a 50 percent inclusion, the same amount that the old GILTI established, while the District of Columbia requires 100 percent inclusion. At the very least, Oregon should join the states that require a 50 percent inclusion.

If Oregon began requiring multinational corporations to include 50 percent of GILTI/NCTI in their Oregon tax returns, it would yield an estimated $245 million over a two-year budget period.[5]

There is no downside to Oregon from reforming these corporate tax policies — only upside

By enacting the policy reforms described above, Oregon would collect more revenue that would help support essential services like the Oregon Health Plan and the Supplemental Nutrition Assistance Program, which help keep Oregonians healthy and fed. So the upside of such a move is clear.

But are there any downsides? Actually, there are none:

- No impact on Oregon-only businesses. Businesses operating solely in Oregon or the United States would see no impact on their tax bill as a result of these changes. The only companies potentially affected by the changes would be large, multinational corporations — companies with foreign subsidiaries and activities.

- No change to investment in Oregon. Disconnecting from FDII/FDDEI and increasing the amount of GILTI/NCTI Oregon taxes would have no impact on investment flows into Oregon. The reason is that Oregon uses what’s called “single sales factor” apportionment, which means that a corporation’s income tax bill in Oregon ultimately rests only on how much it sells in Oregon and nothing else. How many employees, offices, or factories it has in Oregon is irrelevant for tax purposes.

- Corporate tax increases are mostly paid by out-of-state investors. Research from the Institute on Taxation and Economic Policy notes that about 89 percent of corporate tax increases are paid by either foreigners (35 percent) or out-of-state Americans (54 percent).[6] And of the 11 percent paid by Oregonians, the vast majority would be paid by the most well-off Oregonians.

Oregon should protect schools and essential services, rather than coddle the multinational corporations that manipulate the tax system

Funding for schools and essential services, like health care and housing, is at risk due to the massive tax and budget bill passed by the Republican majority in Congress. Not only does the bill shift costs for Medicaid and nutrition assistance to states, but Oregon’s rolling reconnect policy means that the state is doubling down on many of the tax breaks included in the Republican tax and budget bill. These tax breaks, which favor the rich and corporations, are on course to vaporize about $900 million in revenue that Oregon had already budgeted. FDII/FDDEI and GILTI/NCTI play a significant part in that loss.

By getting rid of FDII/FDDEI and increasing GILTI/NCTI to at least 50 percent, Oregon would preserve an estimated $380 million in a full budget period and about $190 million in the current 2025-2027 budget.[7]

At a time when families are struggling with the rising cost of living, the choice for Oregon lawmakers is clear: protect funding for schools and essential services, rather than hand out gifts to multinational corporations that engage in tax avoidance schemes.

Endnotes

[1] Preliminary revenue impact provided by Chris Allanach, Oregon Legislative Revenue Office, via email on November 3rd, 2025.

[2] Analysis based on data provided by Mary Fitzpatrick, Oregon Department of Revenue, via email on October 21st, 2025.

[3] Analysis based on data provided by Mary Fitzpatrick, Oregon Department of Revenue, via email on January 24th, 2025.

[4] Preliminary revenue impact provided by Chris Allanach, Oregon Legislative Revenue Office, via email on November 3rd, 2025.

[5] Preliminary revenue impact provided by Chris Allanach, Oregon Legislative Revenue Office, via email on November 3rd, 2025.

[6] Data confirmed by Miles Trinidad, Institute on Taxation and Economic Policy (ITEP), via email on October 30th, 2025.

[7] Preliminary revenue impact provided by Chris Allanach, Oregon Legislative Revenue Office, via email on November 3rd, 2025.