When it meets in a special session, the Oregon legislature should use the opportunity to eliminate an existing, inequitable tax loophole benefiting certain owners of pass-through businesses. Governor Kate Brown has called on lawmakers to meet in a special session on May 21 to extend the tax loophole to sole proprietors, who are currently excluded from its benefits.[1] While extending the tax break to sole proprietors would eliminate one inequity, it would expand a tax loophole heavily skewed in favor of the most well-off, further undermining funding for core services. And it would leave in place a tax scheme stacked against Oregonians who make a living from a paycheck.

Absent a full repeal of the tax loophole, the Oregon legislature should at least ensure that any changes to the tax break do not take away even more resources from schools, affordable housing, and other essential services. Any extension of the tax loophole to sole proprietors should be paid for by eliminating its benefits for those at the top of the income ladder.

Background: Oregon’s tax loophole for pass-through businesses

“Pass-through” businesses are companies that do not pay corporate taxes on their profits. Instead, the businesses pass the profits to their owners, who report the profits as income on their personal income taxes. Pass-through businesses include S-corporations, partnerships, limited liability companies, and sole proprietors. Pass-through businesses come in different sizes, including some large companies.[2] By contrast, businesses structured as C-corporations — which can also be large or small — are subject to the corporate income tax. Any profits distributed by a C-corporation to its shareholders are taxed by the Oregon personal income tax like any other income.

In a 2013 special session, the Oregon legislature created a tax loophole benefiting some, but not all, owners of pass-through businesses. To qualify, the owner must be an active owner in the company, and must employ at least roughly one full-time employee for slightly more than half of the year.[3] The tax scheme established lower tax rates for certain owners of S-corporations, partnerships, and limited liability companies, but excluded sole proprietors. The Governor has cited this particular inequity as the reason to call for a special legislative session.

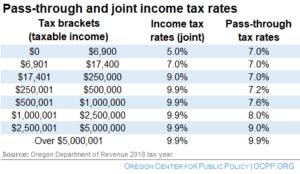

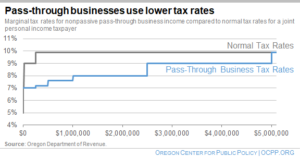

Those able to use the tax loophole can elect to receive a lower tax rate on their pass-through income than they would otherwise pay under the personal income tax rates (the reduced rates appear in the Appendix). The reduced tax rates apply on up to $5 million of pass-through profits in a year. For example, a business owner with pass-through income of $500,000 in a given year would save over $11,000 in taxes. For a business owner who takes full advantage of the reduced rates, meaning they had at least $5 million of pass-through income in a given year, their tax savings amount to over $75,000.

The pass-through business tax loophole is costly

The existing tax loophole for pass-through business owners is costly, diverting funds that would otherwise go to fund schools and essential services. In the current budget period, the tax break is expected to cost about $200 million dollars — money that would otherwise fund services Oregonians depend on.[4] The cost is expected to rise to over $300 million per budget period in the coming years.[5] That is about what it would cost for Oregon to hire more than 1,000 teachers for the full two-years.

Should the legislature do as the Governor has asked and extend the tax scheme to sole proprietors, it would cost Oregon an additional $11.3 million in the current tax year.[6] The cost would rise to $13.7 million in 2022.

The current tax scheme favors high-income earners, and so would extending it to sole proprietors

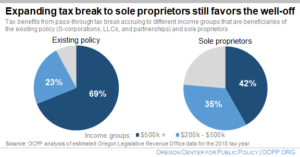

Oregon’s current tax loophole for owners of pass-through businesses heavily favors those at the top of the income ladder. In the 2016 tax year, 69 percent of the tax benefits went to taxpayers making more than half a million dollars per year.[7] Another 23 percent went to taxpayers making between $200,000 and $500,000. Oregonians making $100,000 per year received only 1 percent of the tax benefits.

To put those figures in perspective, the typical Oregon taxpayer — the median taxpayer — earns about $34,400.[8]

Extending the tax loophole to sole proprietors would keep in place the upside-down distribution of benefits from this tax break. About 42 percent of the sole proprietors who would benefit from the extension have incomes above $500,000 a year.[9] Another 35 percent of the benefits flow to sole proprietors with incomes between $200,000 and $500,000. This leaves only 24 percent of the benefit to be shared by all sole proprietors with incomes below $200,000.

The tax scheme creates a two-tier tax system that disadvantages workers

The tax scheme for pass-through business owners creates a two-tier tax system that disadvantages workers, those who make a living from a paycheck. Before 2013, Oregon taxed all income, regardless of how it was earned, under the same set of tax brackets. The pass-through income tax loophole, however, departed from this equal treatment, creating reduced tax rates for certain business owners (see Appendix).

This tax scheme creates a situation where business owners can pay a lower tax rate on their profits than their employees pay on their wages. Adding sole proprietors only exacerbates this injustice by expanding the number of business owners who receive the benefit.

Lawmakers should repeal the tax scheme, but at least ensure it is revenue neutral

When the legislature meets in special session, the best course of action it can take is to eliminate the existing tax loophole for pass-through business owners. While extending it to sole proprietors eliminates one inequity, it leaves in place the more fundamental inequity arising from the tax scheme — that business profits are taxed at a lower rate than workers’ wages. Extending it to sole proprietors would also grow the cost of a tax scheme highly skewed in favor of the richest Oregonians.

Absent a full repeal, lawmakers should at least ensure that any changes to the tax scheme do not take more funds away from Oregon’s schools, affordable housing, or other essential services. Any extension of the tax break to sole proprietors should be paid for by eliminating the reduced tax rates for the higher-income beneficiaries of this tax break, making it revenue neutral.

Further, any changes to the tax scheme short of full repeal should include a “sunset,” an expiration date. Many existing tax breaks contain sunsets; it is a tried-and-true policy. Sunsets force the legislature to scrutinize tax policies periodically, rather than having tax loopholes continue indefinitely without legislative review.

Appendix

Oregon applies one set of income tax rates to all income earned by individual tax filers, except for nonpassive pass-through income that meets certain requirements, which can use a reduced tax rate. Nonpassive income is income earned through material participation in the activities of the business, such as by continually and frequently working in the operations of a business. The comparison of these two sets of tax rates, and a graphical representation, are included below.

[1] Hillary Borrud, “Kate Brown calls May 21 special session to extend business tax break,” The Oregonian, April 24, 2018. In Oregon, the Governor can officially call on the legislature to convene, or the legislative bodies can call themselves back in for a special session. As of this writing, neither of these has happened, but the Governor and legislative leaders communicated that a special session will take place on May 21, 2018.

[2] Juan Carlos Ordóñez, The “small business” smokescreen, Oregon Center for Public Policy, March 2018.

[3] To be precise, the business needs to have employees log 1,200 hours in one year, and only hours accrued in a work week with more than 30 hours count towards the 1,200 threshold. Full information is available in Oregon Revised Statutes 316.043.

[4] Oregon Legislative Revenue Office, Pass-Through Tax Rate Reduction Policy, 2018.

[5] Chris Allanach, Revenue Impact of Proposed Legislation (HB 2060-A), Oregon Legislative Revenue Office, 2017.

[6] Oregon Legislative Revenue Office, “Expanding Oregon’s Pass-Through Tax Rates to Sole Proprietors,” unpublished memo, 2018.

[7] Daniel Hauser, Will the Oregon Senate stick with the GOP playbook on pass-through income? Oregon Center for Public Policy, January 2018.

[8] In 2015, the median Oregon taxpayer earned $34,400. The figure for 2016 is not yet available. See Highest Earning Oregonians Pull Away, Oregon Center for Public Policy, October 4, 2016.

[9] Oregon Legislative Revenue Office, “Expanding Oregon’s Pass-Through Tax Rates to Sole Proprietors,” unpublished memo, 2018.