(Podcast) The rich don’t need more money: why we need to reform the “kicker”

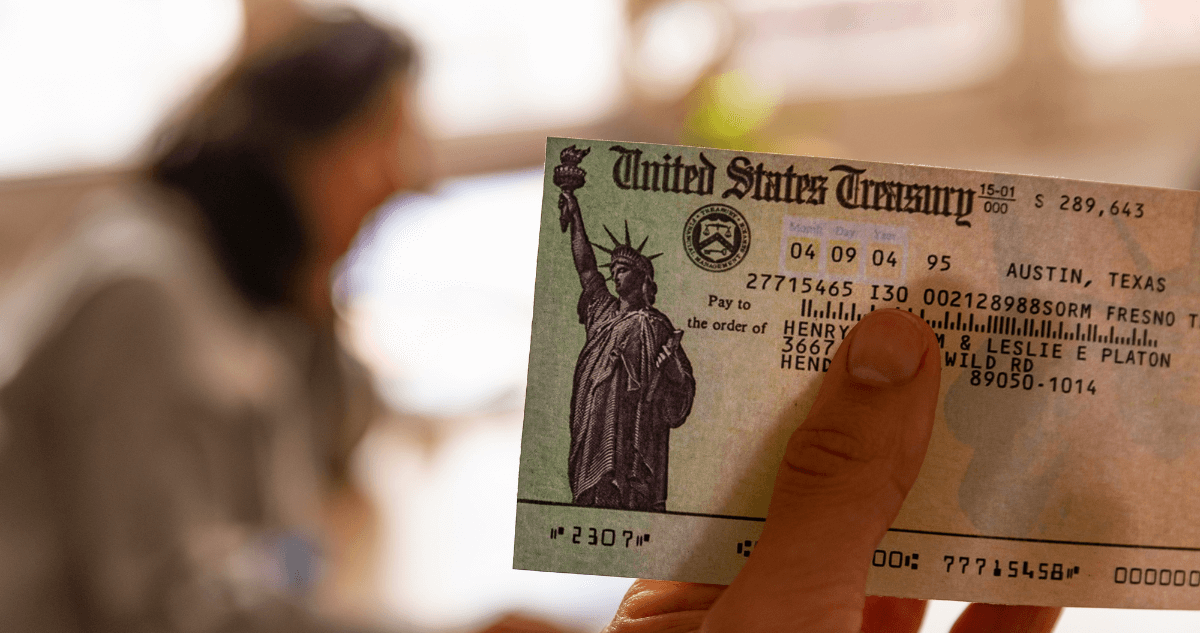

A few weeks ago, we learned that a $3 billion “kicker” rebate could be on its way. As usual, the rich would get huge checks, while the lowest-income Oregonians — those who could really use some extra money to pay the bills — would get chump change.