The Oregon legislature should reject a new tax shelter proposed by the Oregon Association of Realtors dubbed the “Oregon First-Time Home Buyer Savings Account.” The realtors’ association has spent over $750,000 to promote the tax shelter program.[1] Despite its benign sounding name, the association of realtors’ proposal (House Bill 2996 and Senate Bill 849) is structured to benefit the rich, would fail to promote home ownership, and would divert resources from better uses, including schools and affordable housing programs.[2]

The home buyer savings program is structured to mainly benefit the rich

Overwhelmingly, the beneficiaries of the association of realtors’ proposal would be the well-off — those who can most easily come up with a down-payment to buy a home. Middle-class and low-income families would get relatively little or nothing from this tax subsidy.

The program would allow a person to open a “first-time home buyer savings account” at a financial institution. The money deposited in the account (and the earnings generated within) would be tax exempt. In other words, the money going into and out of the savings account would be sheltered from taxation, so long as the money were used to buy a home. Couples (joint tax filers) could shield from taxation contributions up to $10,000 per year, while individuals (single filers) could shield up to $5,000. These accounts could grow to a maximum of $50,000. Account holders could use the savings account to purchase a home for themselves or a designated beneficiary of the account. Thus, parents and grandparents could each set up an account for their children or grandchildren.

The program is structured to benefit well-off families. It is not means tested, allowing the rich — who need no help to buy a home — to gain from this tax shelter as account holders or as beneficiaries. The wealthy are more likely to consult with financial and tax advisors and learn about this tax shelter and how to set one up. And they have the greatest capacity to put away money in such an account, including the ability to max out at $50,000 .

.

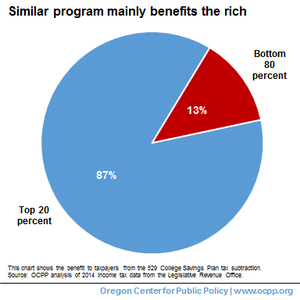

A similar tax shelter program already in existence confirms that the beneficiaries of the first-time home buyer tax savings account will be the wealthy and their kin. The Oregon 529 College Savings Network accounts are set up similarly, though the yearly contribution limits are less than half of those of the home buyer savings program.[3] In 2014, the wealthiest one-fifth of Oregon taxpayers received 87 percent of the tax benefit from the 529 college savings plan subtraction.[4]

There is no reason to think that the primary beneficiaries of the home buyers tax shelter program would be any different than the 529 College Savings program.

There is no evidence the proposal would increase home ownership

The association of realtors offers no evidence this program would boost home ownership in any meaningful way, and there is no reason to think that it would. Because it is tailored to benefit the most well-off, the program would not result in any significant number of home purchases that would not otherwise occur.

Well-off families already help their adult children buy their first home. Among young (under 35) first-time home buyers, 28 percent relied on a loan or gift from family or friends to make the down payment, according to a recent Federal Reserve survey.[5] That survey also found that 10 percent of young first-time home buyers reported relying exclusively on family or friends for the down payment.

Well-off families that have the resources and intention to help their children purchase their first home are the likely beneficiaries of the Association of Realtor’s tax shelter program, as the data from the similarly structured 529 College Savings Plan demonstrates. Thus, the tax savings program would simply provide a tax shelter for wealthier families to do what they would do anyway.

The association of realtors has put forward no evidence this program would cause home purchases that would not otherwise occur. A report written by a consulting firm under contract with the association of realtors claims the program would result in 3,221 participants in the program during the first five years.[6] The report bases this unproven estimate on the “pent up” demand for home ownership.[7] A careful reading of the report reveals that the authors simply assume the program would cause some of the pent up demand to translate into actual first-time home buyers.

The realtor-sponsored study fails to acknowledge the possibility that those participating in the program would save for a down payment, for themselves or their relatives, even in the absence of the program. To the extent that the study addresses the economic status of the potential first-time home buyers, the data presented confirms that the proposed program would do little to promote home ownership. The realtors’ report makes clear that the majority of potential first-time homebuyers are finding it difficult to save for a down payment because they are cash-strapped:

Nearly 60 percent of first-time home buyers nationally said in 2015 that student loan debt was the primary reason they delayed starting to save for a down payment. In addition to household debt, rising rents, health care costs, and education expenses are increasingly a burden for many households, leaving less and less disposable income that can be set aside to save to buy a home.

For these households — presumably the main target of the program — establishing a tax savings account would not help them save money for a down payment, because they lack the money to save.

The scant evidence of similar programs in other states offers no support for the claim that this program would promote home ownership. Montana is the only state with a similar tax shelter in place for several years.[8] Since 2007, Montana has only had between 126 and 214 residents per year contribute to a tax-exempt home buyer savings accounts. Nothing in the Montana tax expenditure report shows these savers would not have put money aside without the existence of the first-time home buyers tax shelter. There is also no data on the total number of home purchases by participants of the Montana program. Two states, Virginia and Colorado, only recently adopted tax shelters similar to the Oregon realtors’ proposal, so there is no track record yet.

As designed, it would be difficult to evaluate whether the program caused any first-time home purchases. Unlike a loan or grant program, the beneficiaries of the shelter (the account beneficiaries) would not need to prove that “but for” the subsidy the home purchase would not take place.

The proposed tax spending program will divert revenue from better uses

The proposed first-time home buyers tax shelter will divert money from the Oregon General Fund that would be better spent funding schools, health care or programs to help those Oregonians struggling as a result of the state’s severe housing crisis.

The association of realtors’ claim that the program would pay for itself is wishful thinking at best. The realtor-sponsored study maintains that the economic activity caused by the home buying allegedly engendered by the tax shelter program would eventually result in more tax revenue than without the program. The study claims, for example, that new construction jobs will result in more income tax and real estate transfer tax receipts for the state. This argument, however, rests on the flawed assumption that the program would generate home buying that would not otherwise occur. As discussed above, the structure of the program makes such an assumption unwarranted.[9]

It is unclear how much the tax shelter program would cost the state. Whatever the amount would be, there are much better uses for that money than spending it on what would mainly be a housing subsidy for well-off families.[10]

Reject the tax shelter program, or at the very least, means-test it

The best course of action in terms of sound public policy would be to reject the program outright. The program is structurally flawed, designed to mainly benefit the well-off who do not need the state’s assistance in buying a home for themselves or their kin. It will fail to promote home ownership in any meaningful way. And it is ill-designed to evaluate whether the shelter caused the first-time home purchase.

Should the legislature choose to pursue this program, at the very least it should set strict income eligibility limits on both the account holders and the beneficiaries. The program should be structured to target middle-class and lower-income families. One way to accomplish this would be to set the limit for account holders and beneficiaries at 120 percent of Oregon median household income.

At a time when the wealthy already enjoy many advantages, including the ability to purchase a home for themselves and their kin, the last thing Oregon needs is another ineffective, unaccountable subsidy for the well-off.

[1] ORESTAR report on Oregon First Home Coalition, April 10, 2017, available at https://secure.sos.state.or.us/orestar/cneSearch.do?cneSearchButtonName=search&cneSearchFilerCommitteeId=18464

[2] House Bill 2996 & Senate Bill 849 contain the same language and can be accessed at https://olis.leg.state.or.us/liz/2017R1/.

[3] 2017-19 Oregon Tax Expenditure Report, p. 109, available at https://www.oregon.gov/DOR/programs/gov-research/Documents/full-tax-expenditure_2017-19.pdf.

[4] Ibid.

[5] Report on the Economic Well-Being of U.S. Households in 2015, Board of Governors of the Federal Reserve, May 2016, at 39.

[6] The Economic and Fiscal Impacts of Proposed First-Time Home Buyer Income Tax Deduction Legislation in the State of Oregon, Lisa Sturtevant & Associates, LLC, and Urban Analytics, Inc., March 2017. This study is available at https://olis.leg.state.or.us/liz/2017R1/Downloads/CommitteeMeetingDocument/110908.

[7] Ibid. at 22.

[8] Montana Department of Revenue Biennial Report page 264 available at https://revenue.mt.gov/Portals/9/publications/biennial_reports/2014-2016/2016-Biennial-Report-Complete.pdf

[9] In discussing the economic benefits of the proposed home buyer savings program, the study also fails to account for the economic benefits of the rental market. For example, the study purports to estimate the economic activity, including jobs, that would flow from the building of new homes (purportedly from the tax savings program), but fails to consider the rental units that would be built, and jobs that would thus be created, in the absence of those new homes.

[10] Stutevant & Bellas estimate there would be $1,997,562 in personal income tax revenue generated from the economic activity resulting from the program, and a total foregone income tax revenue of $3,670,564 in the five-year period analyzed.