SB 5: Reject the R&D Tax Credit

Co-Chairs Sollman and Bynum, Co-Vice Chairs Knopp and Wallan, and Members of the Committee, My name is Daniel Hauser (he/him), Deputy Director for the Oregon Center for Public Policy and

Co-Chairs Sollman and Bynum, Co-Vice Chairs Knopp and Wallan, and Members of the Committee, My name is Daniel Hauser (he/him), Deputy Director for the Oregon Center for Public Policy and

[This commentary first appeared in The Oregonian.] We all want Oregon to prosper. We all want our state to be the home of innovation. To achieve that, public policies must be

Chair Nathanson, Vice-Chairs Reschke and Walters, and members of the committee, My name is Daniel Hauser, Deputy Director for the Oregon Center for Public Policy, and I respectfully submit this

Oregon can clamp down on multinational corporations shifting profits overseas, create a more level playing field for Oregon businesses, and raise millions in revenue by enacting “complete reporting” by large

Chair Gelser Blouin, Vice-Chair Robinson, and Members of the Committee: My name is Daniel Hauser, Deputy Director for the Oregon Center for Public Policy, and I respectfully submit this testimony

Note: This invited testimony was provided at an informational meeting of the Senate Committee on Housing and Development on 3/13/2023. Chair Jama, Vice-Chair Anderson, and members of the Committee My

Note: The paper was updated on September 19, 2023 to capture data from a new revenue forecast and additional data provided by the Oregon Office of Economic Analysis. As working

The Oregon Center for Public Policy has repeatedly made clear that investing in people and place, not tax breaks and direct corporate subsidies, is the right approach to improve the lives

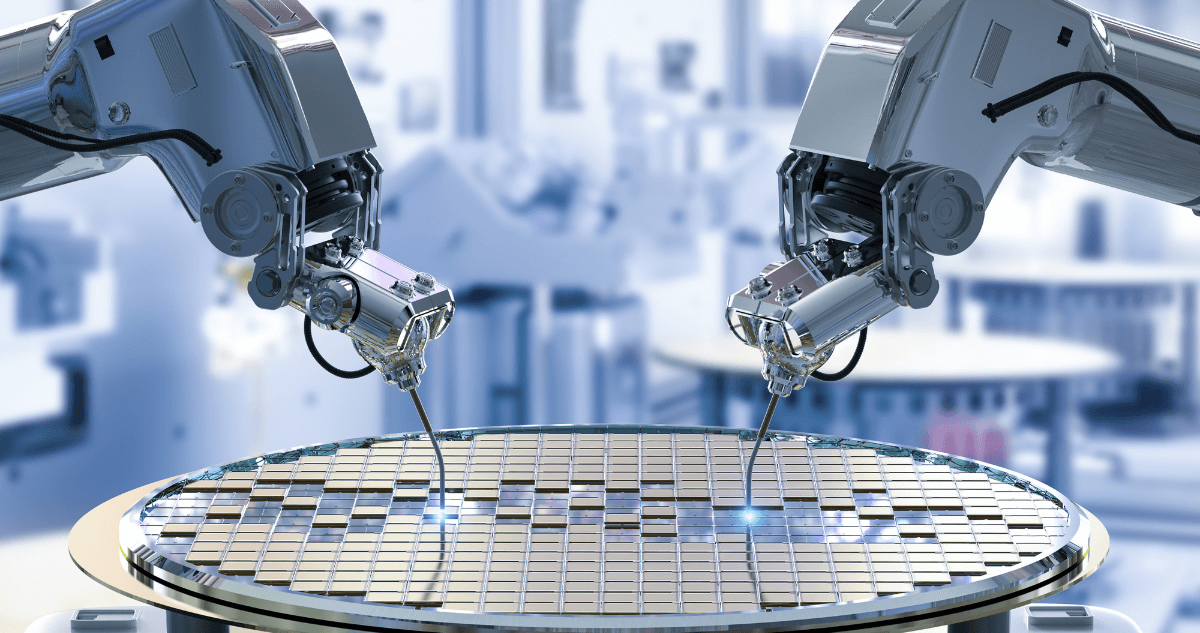

After Congress dedicated billions of dollars to semiconductor investments in the U.S., Oregon legislative leaders have lined up behind an effort to attract additional semiconductor investment to Oregon. This is

Chair Reynolds, Vice-Chairs Scharf and Nguyen, and Members of the Committee, My name is Daniel Hauser, Deputy Director for the Oregon Center for Public Policy, and I respectfully submit this