The Data Tells a Different Story: Oregon’s Economy Has Grown Faster Than Most

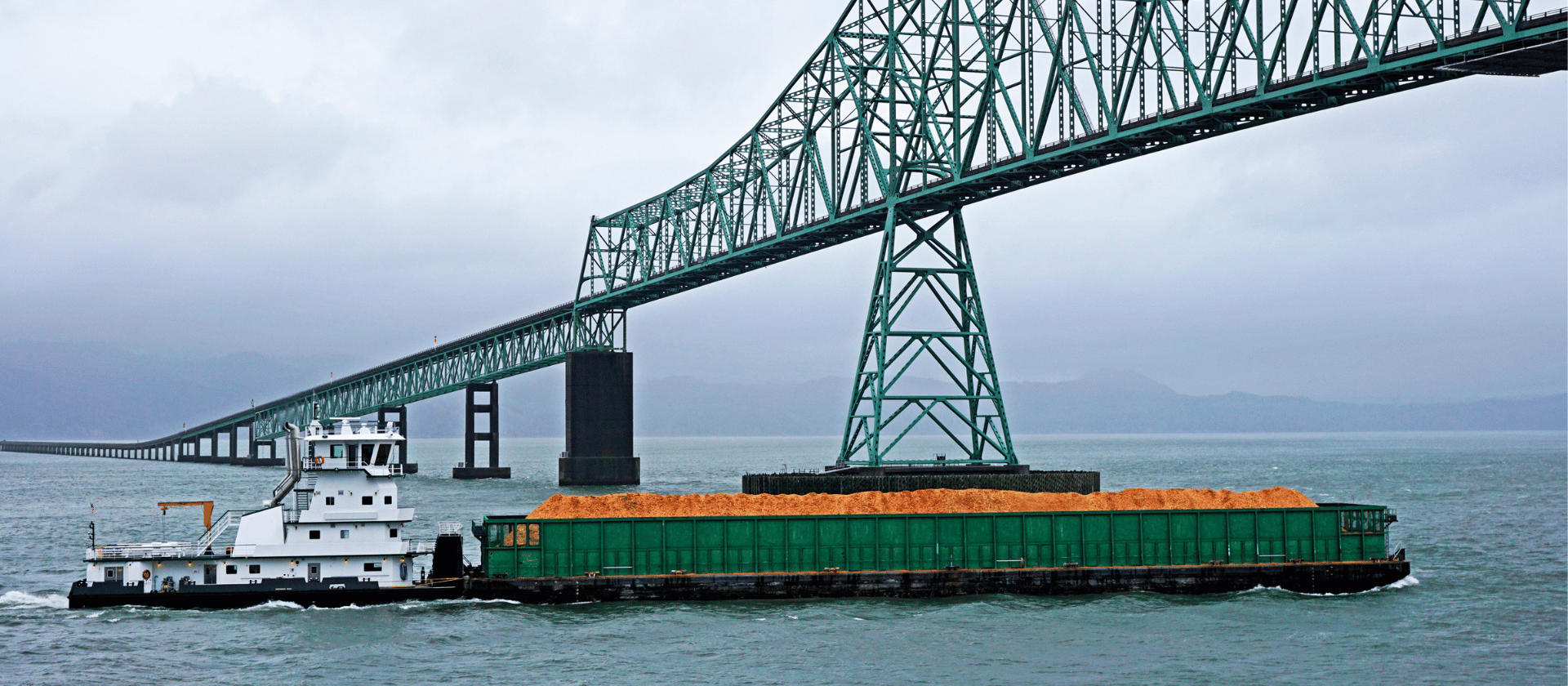

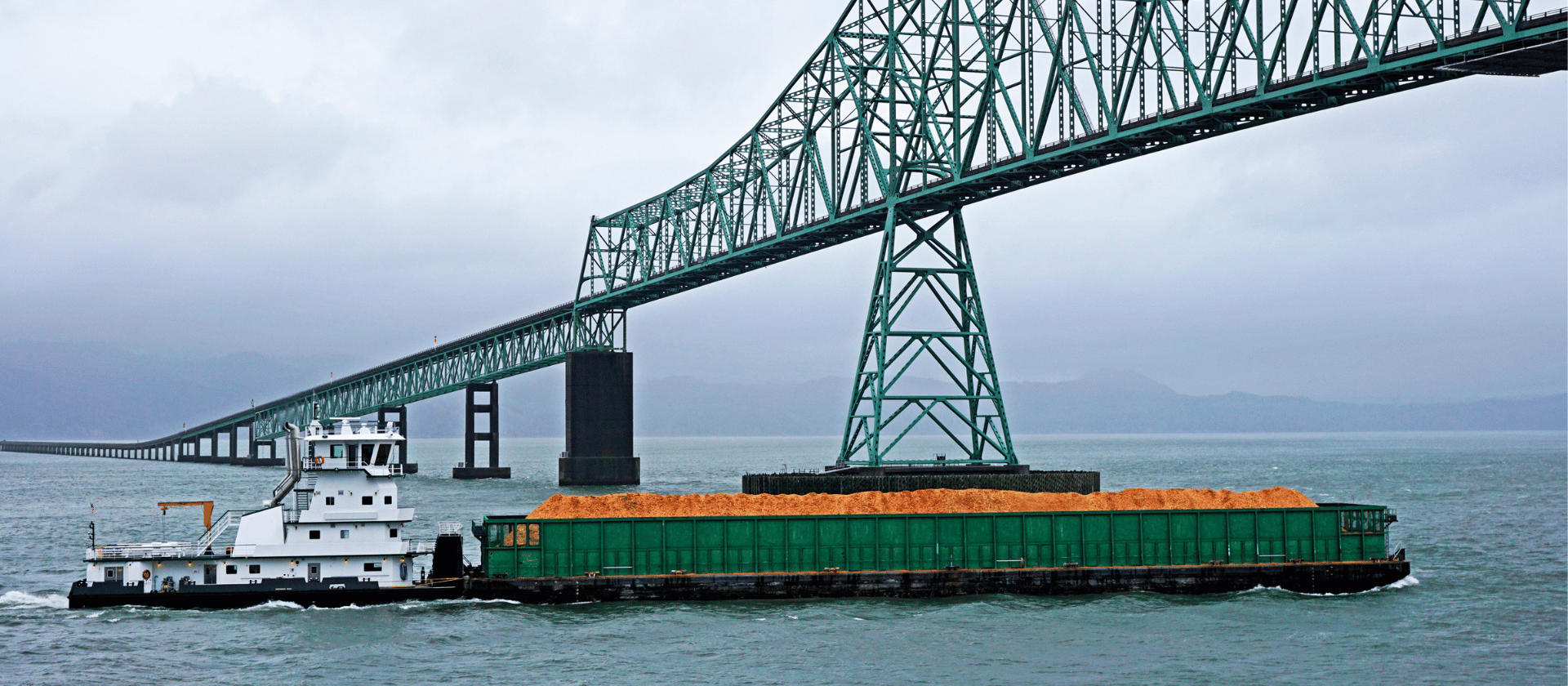

If you follow news coverage about Oregon’s economy, you may be surprised to learn the following: Oregon’s economy has grown faster than that of most states on a per capita

If you follow news coverage about Oregon’s economy, you may be surprised to learn the following: Oregon’s economy has grown faster than that of most states on a per capita

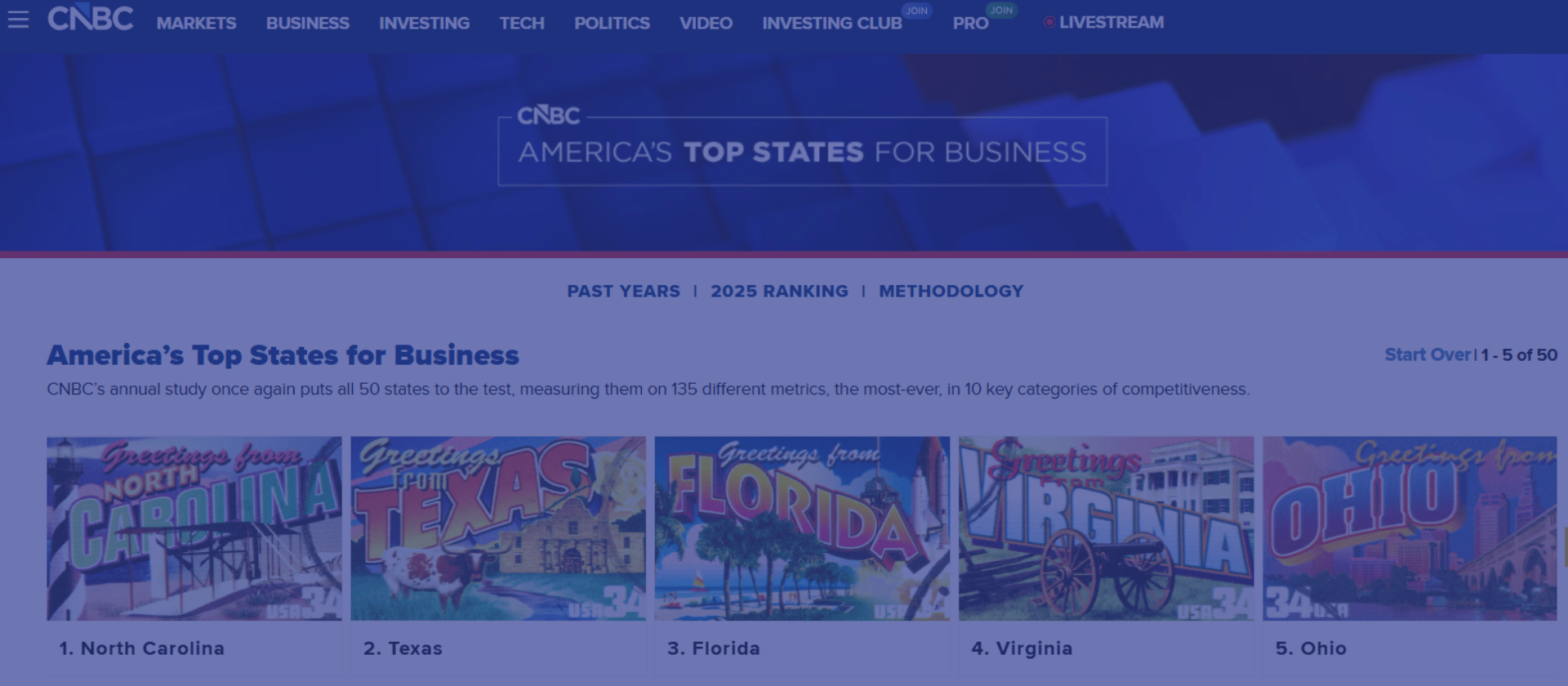

Governor’s goal of landing Oregon on CNBC’s Top 10 states for business signals another walk down the failed path of trickle-down economics

Much of the progress Oregon has made in expanding health care access is at risk as a result of the federal budget reconciliation bill enacted by Congress. In this episode

Exempting overtime pay from taxes harms the vast majority of workers, while creating opportunities for the rich to game the system

In celebration of May Day, International Workers Day, we are issuing this special episode of Policy for the People examining the state of the labor movement. Our guest is Don

For too long, Oregonians have had to go through a middle-man to file taxes. But now, Direct File has arrived, providing a better way to file taxes.

Many older workers run up against age discrimination in the workplace. The Oregon legislature needs to remedy the problem, says Andrea Meyer of AARP Oregon.

Tax subsidies for data centers bring few benefits for Oregonians and many downsides

Rather than open job opportunities for native-born workers, mass deportations would lead to a negative ripple effect throughout the job market.

Measure 116 would create an independent commission that would decide the salaries for lawmakers, the governor and other state elected officials.