Undocumented would pay more in taxes than the top 1 percent

Undocumented Oregonians pay taxes, which is one of the ways they contribute to Oregon’s economy. The taxes help fund schools and other public services that make our economy stronger. These immigrant Oregonians and aspiring citizens would contribute so much more under comprehensive immigration reform that, as a share of income, their tax contributions would surpass those of the wealthiest 1 percent.

The fate of a recent presidential executive order on immigration puts this in jeopardy.[1] The executive order was expected to increase Oregon state and local revenue collections. A court ruling blocking the order, however, effectively puts on hold the increased tax contributions from the affected immigrant population.

Download a copy of this fact sheet:

Immigration Reform Would Boost Oregon State and Local Budgets (PDF)

Related materials:

Undocumented Immigrants’ State & Local Tax Contributions (PDF), Institute on Taxation and Economic Policy (ITEP), April 2015.

Undocumented Oregonians are taxpayers

Like other Oregonians living and working in the state, undocumented Oregonians contribute state and local taxes. Undocumented Oregonians pay income taxes. They pay property taxes directly if they are homeowners and indirectly if they rent a residence. They also pay excise taxes on goods such as gasoline, tobacco and alcohol they purchase.

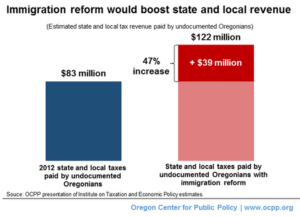

How much do undocumented Oregonians contribute in state and local taxes? A recent report by the Institute on Taxation and Economic Policy (ITEP) estimated that 124,000 undocumented Oregonians paid more than $83 million in state and local taxes in 2012.[2]

Legal status for immigrants boosts state and local budgets

Immigration reform boosts state and local revenue collections. When previously undocumented workers earn legal status, they tend to earn and to consume more, which means they contribute more in the form of income, property and excise taxes.[3] Also, workers with legal status must be in full compliance with state and local tax systems. Thus, granting a path to citizenship increases the number of workers paying income taxes.

Granting a path to citizenship to all undocumented Oregonians would further boost state and local tax collections. Comprehensive immigration reform would increase Oregon state and local revenue by about $39 million a year.[4] Thus, a path to citizenship would result in about a 47 percent increase in the tax contributions by Oregonians who are currently undocumented.[5]

The judicial hold on executive action costs Oregon millions

In 2014, President Obama issued an executive order allowing certain undocumented parents and children to apply for temporary legal status. That executive order created the Deferred Action for Parents of Americans and Lawful Permanent Residents (DAPA) and expanded the existing Deferred Action for Childhood Arrivals (DACA) programs. The order affects an estimated 63,000 undocumented Oregonians.[6]

A federal court in Texas, however, has blocked the executive order, costing Oregon millions in foregone tax revenue.[7] ITEP estimates that Oregon state and local revenues would increase by $18 million a year with DAPA and DACA fully implemented.[8] The federal court’s decision blocking the President’s order effectively puts on hold the increased tax contributions from the affected immigrant population.

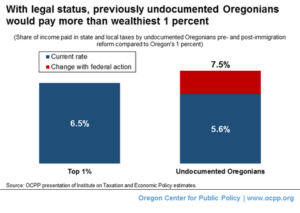

Immigrants would pay a higher tax rate than the top 1 percent

Immigration reform would increase the tax contributions of currently undocumented workers to such an extent that, as a share of their income, these workers would pay more in state and local income taxes than Oregon’s wealthiest 1 percent.

As a group, undocumented Oregonians currently pay about 5.6 percent of their income in state and local taxes. Immigration reform would elevate that share to about 7.5 percent.[9] At that point they, like nearly all Oregonians, would pay a larger share of their income in state and local taxes than Oregon’s wealthiest 1 percent, who as a group pay at a rate of about 6.5 percent.[10]

Conclusion

Undocumented immigrants already support state and local services with their tax dollars. Creating a path to citizenship for undocumented workers would increase state and local revenue, which fund schools and other services that benefit all Oregonians.

[1] In November of 2014, President Obama used his executive authority to expand Deferred Action for Childhood Adults (DACA), which protects certain undocumented youth from deportation; and create Deferred Action for Parents of Americans and Lawful Permanent Residents (DAPA), which protects certain undocumented parents from deportation. For more see DAPA & Expanded DACA, National Immigration Law Center, March 2015.

[2] Gardner, Matthew, Sebastian Johnson and Meg Wiehe, Undocumented Immigrants’ State & Local Tax Contributions, Institute on Taxation and Economic Policy (ITEP), April 2015.

[3] Kallick, David Dyssegaard, Three Ways Immigration Reform Would Make the Economy More Productive, Fiscal Policy Institute, June 4, 2013, p. 18-20.

[4] Ibid, p. 3. Increased revenues are increases over estimated 2012 contributions by undocumented Oregonians.

[5] OCPP analysis of ITEP data.

[6] Gardner, Johnson, and Wiehe, Undocumented Immigrants’ State & Local Tax Contributions, p. 20.

[7] State of Texas et al v. United States of America. No. 1:14-cv-00254 (D. Texas Feb. 16, 2015) is the order granting preliminary injunction.

[8] Gardner, Johnson, and Wiehe, Undocumented Immigrants’ State & Local Tax Contributions, p. 3.

[9] Gardner, Johnson, and Wiehe, Undocumented Immigrants’ State & Local Tax Contributions, p. 13.

[10] Institute on Taxation and Economic Policy, Who Pays? A Distributional Analysis of the Tax Systems in All 50 States, January 2015.

More about: immigration, undocumented workers