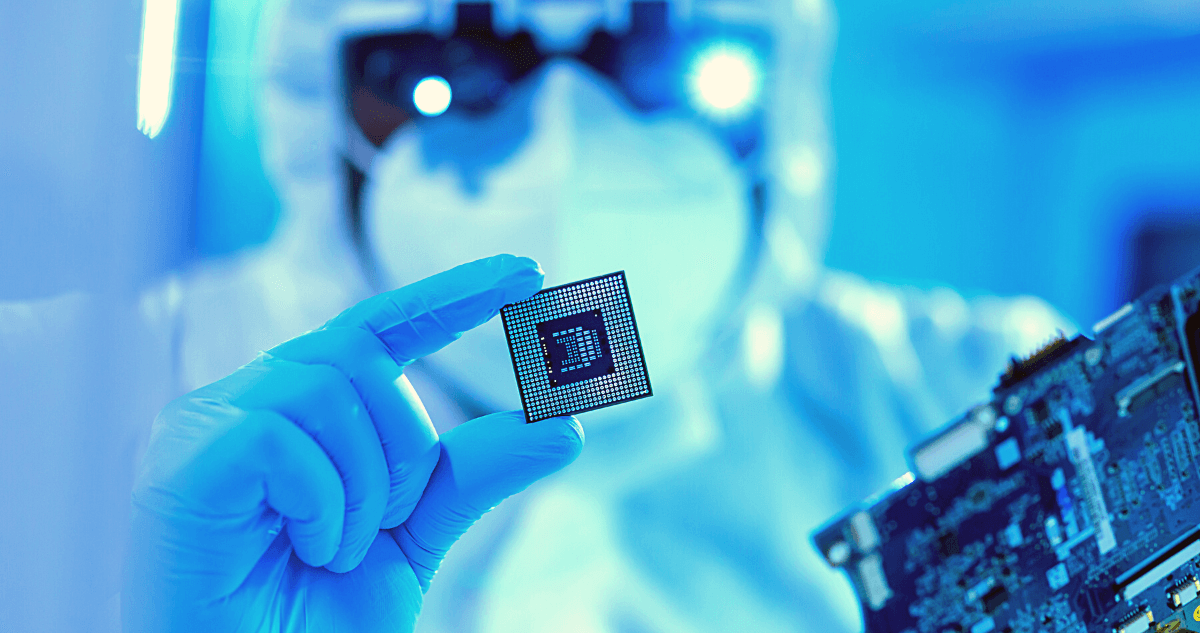

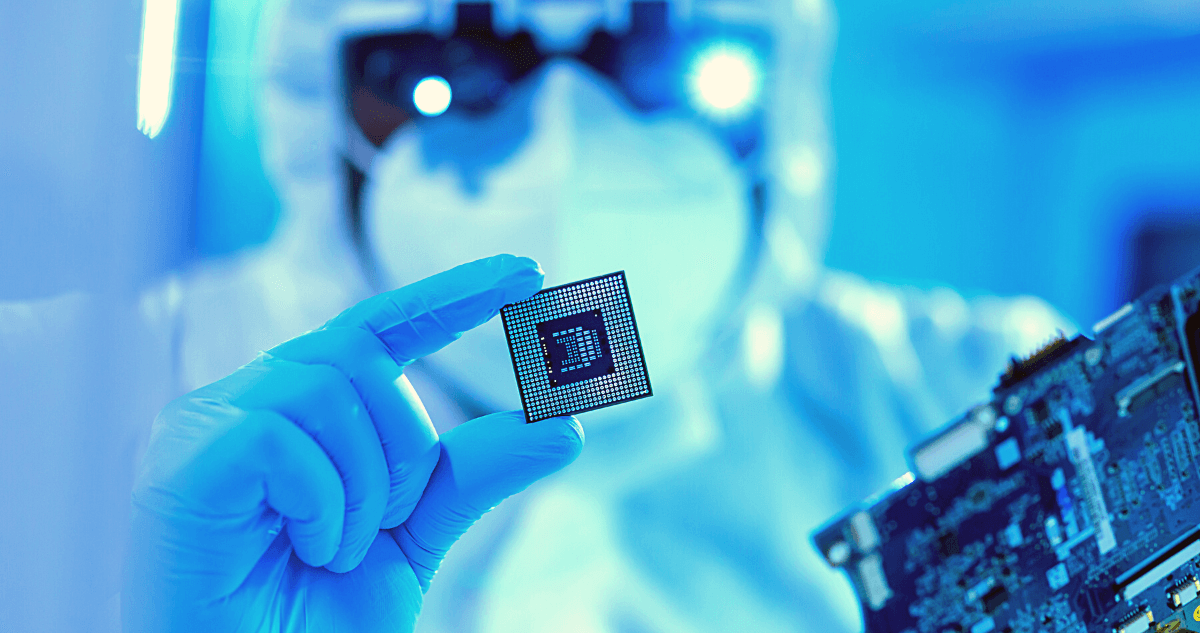

(Podcast) Subsidies for semiconductors: the risk to Oregonians

One of the big topics of discussion in Salem right now is whether to provide new subsidies for semiconductor companies like Intel. This push for new subsidies stems from the

One of the big topics of discussion in Salem right now is whether to provide new subsidies for semiconductor companies like Intel. This push for new subsidies stems from the

There are important steps Oregon can take during the 2023 legislative session to advance economic justice.

Is there a way for Oregon to ensure that everyone in our state has access to affordable, quality health care? And can it be done at a lower cost compared to our current, complicated system of health care?

Important update: Oregon Kids’ Credit is now available Eligible families can begin claiming the Oregon Kids’ Credit this tax filing season. The Oregon Department of Revenue has information available on

The work of Oregon Center for Public Policy has contributed to significant policy victories that improve the lives of Oregonians.

Making Oregonians more economically secure requires investing in our well-being: housing, education, child care, and more.

By law, we are required to provide certain tax documents to the public upon request.

Data for the People provides the latest publicly-available data on the economic well-being of Oregonians.

The strengthening of the federal Child Tax Credit in 2021 caused child poverty to plummet. Unfortunately, those changes were temporary, and now millions of kids across the country are falling back into poverty, due to congressional action.