If you care about gender justice, you need to care about the tax code

The first television sitcom, Jackson and Jill, aired in 1949. It featured a family structure reprised in many TV shows to follow: a working husband and a stay-at-home wife .

The first television sitcom, Jackson and Jill, aired in 1949. It featured a family structure reprised in many TV shows to follow: a working husband and a stay-at-home wife .

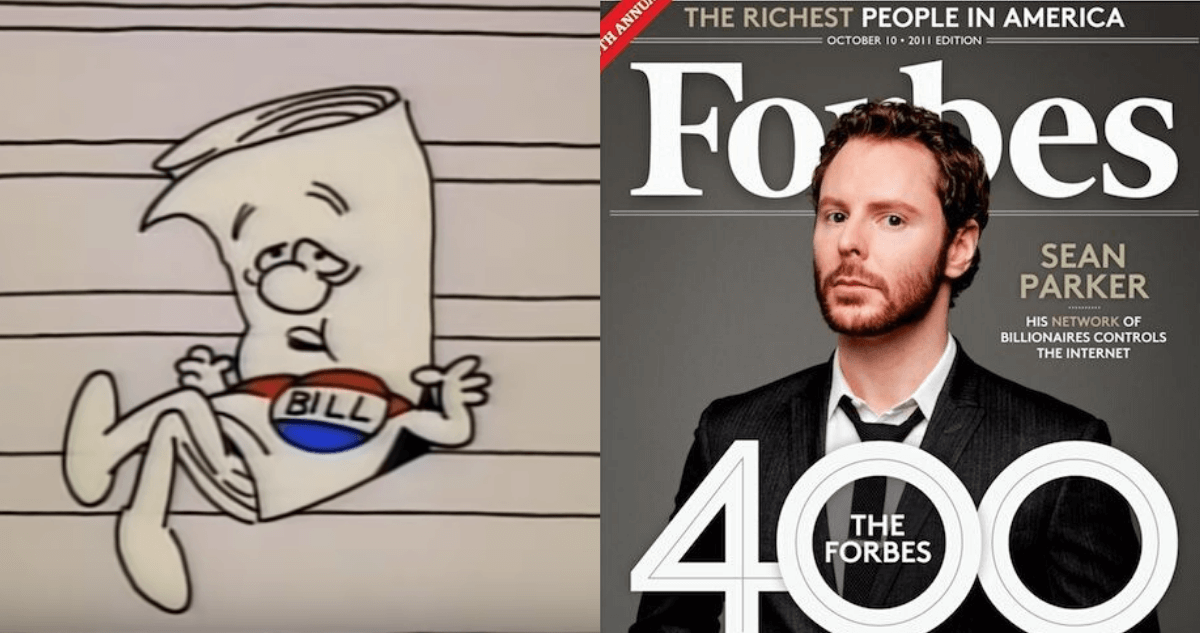

Fans of the classic kids’ television show Schoolhouse Rock will remember How a Bill Becomes Law, the animated music video explaining the legislative process.

At a time when so much of the nation’s wealth is concentrated in the hands of so few, some Oregon lawmakers are making it their priority to further boost the fortunes of wealthy families.

To find the way forward, it often helps to look at the past. That’s certainly the case when it comes to tax policy. Rather than rely on preconceived notions, it’s essential to examine the real impact of significant policy changes.

As 2019 draws to a close, we look back at the Center’s publications that proved most popular. Here they are, starting with the fifth most popular:

Following the failed playbook of trickle-down economics, the tax package lavished massive tax cuts on the rich and corporations.

If two people earn the same amount, they should pay the same tax rate. That’s a bedrock principle of tax fairness. Oregon had long lived by this rule, until one shameful day six years ago today.

State lawmakers have much to be proud of, having enacted Oregon’s largest investment in education in memory. This and future generations of Oregonians will be better off for it.

This May Day arrives as many workers in Oregon struggle just to get paid for their labor.

One night a year, authorities and volunteers nationwide count the homeless. The most recent count revealed less than half of Oregon’s homeless families with children found shelter that night.