4 reasons why Oregon’s corporate minimum tax is too low

Oregon’s corporate minimum tax needs a significant boost for it to meet its intended purpose — ensuring that all corporations make a meaningful contribution to the common good.

Oregon’s corporate minimum tax needs a significant boost for it to meet its intended purpose — ensuring that all corporations make a meaningful contribution to the common good.

As 2018 draws to a close, we look back at the Center’s publications that proved most popular.

Oregon teachers deserve a raise. Teachers play an essential role in helping children achieve their potential and contribute to our communities. Unfortunately, Oregon significantly underpays its teachers relative to comparable workers in the private sector.

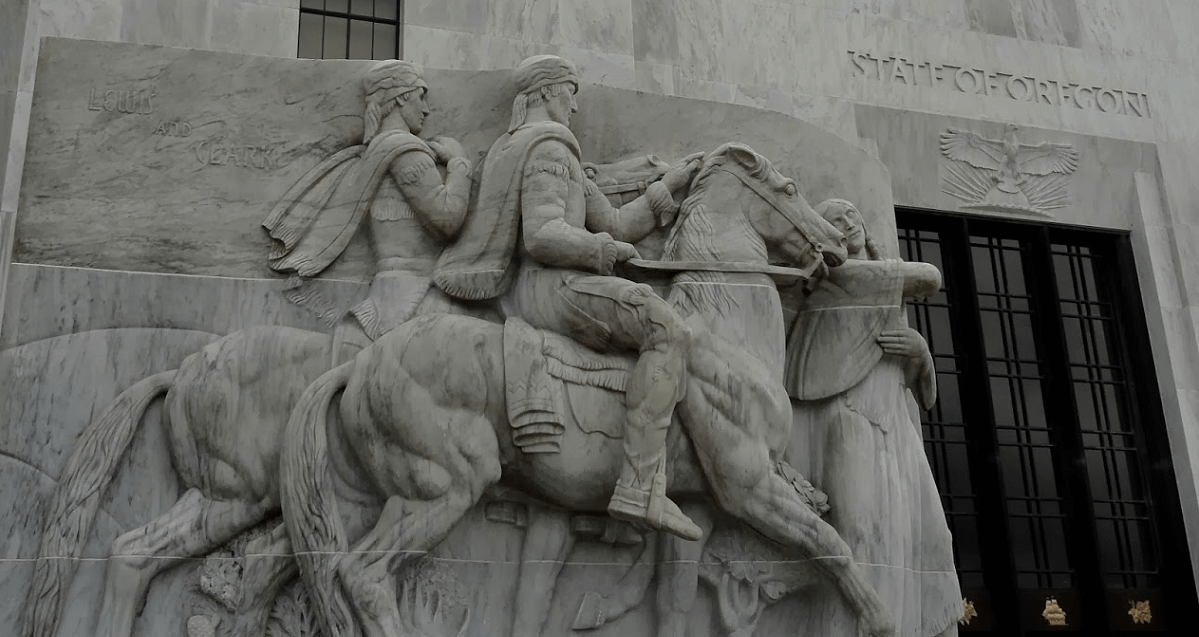

In 1862, not long after joining the Union, Oregon enacted a tax on people of color. If you were black, mixed-race, Hawaiian, or Chinese, you had to pay a tax not levied on white Oregonians.

Of the many threats that Measure 103 poses, one has received too little attention: Measure 103 takes control away from communities on matters of public finance and community health.

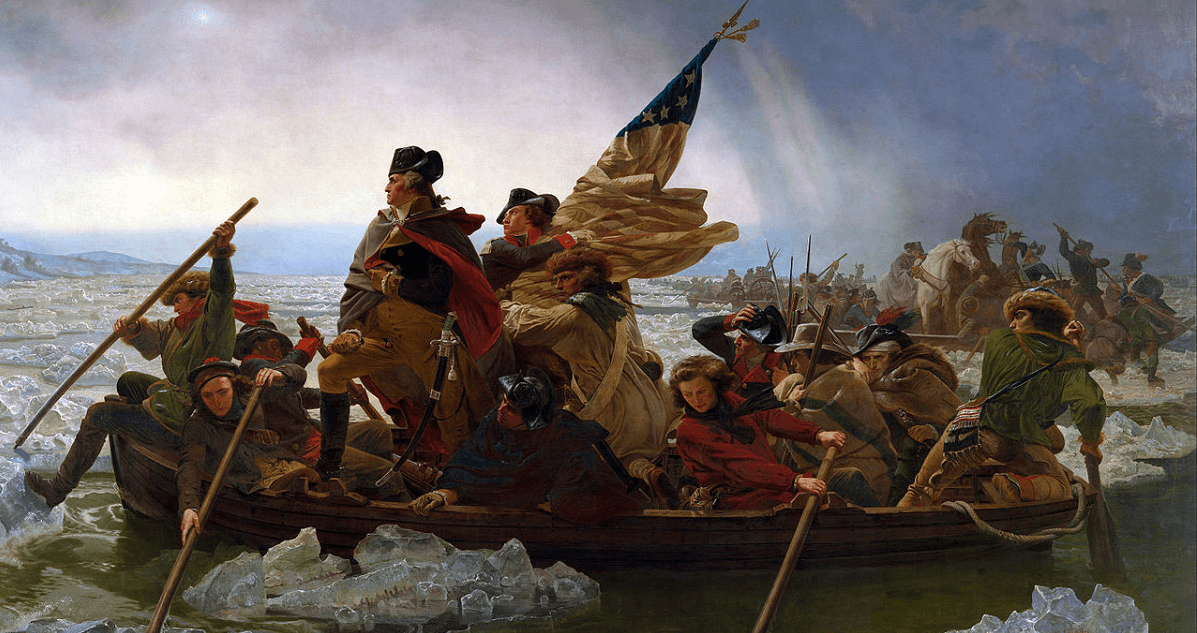

“Poison.” That’s what Alexander Hamilton called requiring a supermajority to pass laws.

As Election Day nears, three of the nation’s largest corporations are attempting to scare Oregonians into voting for a ballot measure whose real purpose is to protect their bottom line, not the wallets of working families.

In 2015, Google came knocking in Salem. One of its divisions, Google Fiber, was going around the country peddling its new gigabit broadband service.

The Trump administration is looking to pour gasoline on the fire that is Oregon’s housing crisis.

It’s official. Governor Kate Brown has proclaimed a special session of the legislature on May 21.